40th Parliament

November 6, 2014

Composition of the Legislative Assembly Management Committee

Departmental Performance Report

Appendix A: Legislative Assembly Management Committee Decisions

November 2014

To the Honourable Legislative Assembly of the Province of British Columbia

Honourable Members:

The 2013-14 year was important for the BC Legislative Assembly, and for all British Columbians.

The 2013-14 year was important for the BC Legislative Assembly, and for all British Columbians.

On May 14, 2013, British Columbians elected the 85 Members of their 40th Parliament. The new Parliament opened on June 26, 2013. By March 31, 2014, the Legislative Assembly had debated and adopted government’s June 2013 and February 2014 budgets, passed ten bills, held 85 parliamentary committee meetings, and welcomed almost 90,000 visitors, including students from over 500 schools across the province.

The Legislative Assembly Management Committee held public discussions of options for the Assembly’s budget, and scaled back expenditures to a “hold the line” budget for 2014-15. We improved oversight and controls over Assembly expenditures. We expanded the disclosure of information on Assembly budgets, Members’ travel, and constituency office expenses. And, we obtained feedback from the Office of the Auditor General and financial professionals as we worked to modernize our governance and financial administration.

I am very pleased to present the Legislative Assembly Management Committee’s first Accountability Report. It outlines our concrete actions to improve the Legislative Assembly’s financial management and administration, and provides the Assembly’s first independently audited annual financial statements.

I am grateful to the Members of the Committee for their contributions to an open and accountable Legislative Assembly, and to the staff who support the work of the Legislative Assembly and its Members on behalf of the people of British Columbia.

Respectfully submitted on behalf of the Committee,

Honourable Linda Reid

Speaker of the Legislative Assembly of British Columbia

|

|

|

|

|

|

|

|

Craig James

Clerk of the Legislative Assembly

The Legislative Assembly’s staff provide non-partisan services and advice to the Assembly, its Members, and its parliamentary committees.

The Legislative Assembly’s staff provide non-partisan services and advice to the Assembly, its Members, and its parliamentary committees.

In 2013-14, our strategic goals were: to support the Legislative Assembly’s key functions; to deliver effective, responsive and accountable financial management and administration; to ensure that Members and British Columbians are well-informed about the work of their Legislative Assembly; and to provide a safe and secure environment for all Members, staff and British Columbians.

Highlights of the past year include:

We look forward to continuing to support the Speaker and the Legislative Assembly Management Committee in strengthening the accountability, transparency, and efficiency of the Legislative Assembly’s administration and operations.

Craig James

Clerk of the Legislative Assembly of British Columbia

|

Speaker's Procession, Legislative Chamber |

The Members of the Legislative Assembly are collectively and individually accountable to British Columbians for the Assembly’s financial policies and administration. British Columbians expect their Members to ensure that Assembly policies and operations provide good value for taxpayers’ funds.

The Assembly established an all-party Legislative Assembly Management Committee (the Committee) in 1992 with the enactment of the Legislative Assembly Management Committee Act.

This all-party Committee serves as the Assembly's parliamentary management board. It is responsible for: the sound administration of the Assembly’s operations; the provision of effective administrative and financial policies and support for Members in the discharge of their parliamentary and constituency responsibilities; and prudent Assembly budgets and expenditures on behalf of all British Columbians.

The Committee consists of the following Members of the Legislative Assembly: the Speaker, who serves as Chair, the Government House Leader, the chair of the Government Caucus, a cabinet minister, the Opposition House Leader, and the chair of the Opposition Caucus. Recent practice has been to appoint the Government Whip in place of a minister.

Guided by a commitment to act in accordance with principles of openness and transparency, the Committee is advancing reforms to strengthen the Assembly’s management of taxpayers’ funds:

|

Parliament Buildings |

The Legislative Assembly Management Committee has advanced initiatives to enhance the Assembly’s governance and financial and administrative management.

The Assembly is working to fully implement the recommendations made by the Office of the Auditor General in its July 2012 report, Audit of the Legislative Assembly's Financial Records, and its April 2007 report, Special Audit Report to the Speaker: Financial Framework Supporting the Legislative Assembly (available at www.bcauditor.com) by:

Fundamental changes have been made to governance and decision-making to support the Committee’s work to strengthen accountability for the management of taxpayers’ money.

In August 2012, the Committee implemented the following reforms to promote openness and the engagement of British Columbians in its deliberations and decision-making:

In October 2012, the Committee established a Finance and Audit Committee comprised of the Speaker, the government and opposition Caucus Chairs, and the Clerk of the Legislative Assembly. The creation of the Finance and Audit Committee is an important “leading practice” for public sector organizations and serves as an advisory sub-committee to the Legislative Assembly Management Committee on financial management and administrative issues.

In 2013-14, additional governance changes were made to increase oversight, rigour and transparency on budgeting and spending.

|

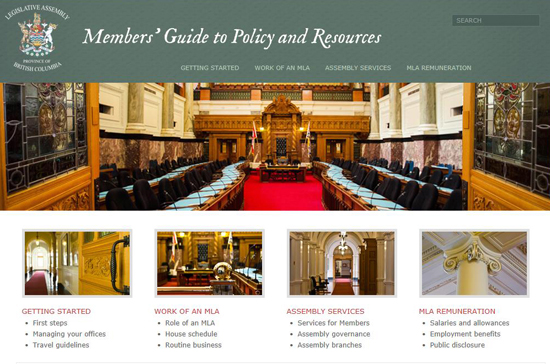

New Members’ Guide to Policy and Resources Website (members.leg.bc.ca) launched May 2013 |

Openness and transparency enable public sector entities to demonstrate that they are serving the public interest, support the engagement of citizens, and foster public trust and confidence in decisions and actions.

The public disclosure of Members’ remuneration and expenses has been advanced through a series of initiatives:

|

Select Standing Committee on Children and Youth, 2014 |

|

Memorial Rotunda |

To support Members in their implementation of new transparency initiatives in 2013-14, the Legislative Assembly enhanced its orientation program for Members and their staff and expanded information and training resources for Members and staff:

The following initiatives have been undertaken to enhance the disclosure of information on Assembly budgets and spending:

The Legislative Assembly Management Committee is overseeing a comprehensive multi-year program to enhance internal financial management and administration. Strengthened professional advice on financial matters is improving support for the Committee’s decision-making. More rigorous internal controls help to ensure systematic and prudent administration of Assembly expenditures.

Sound financial administration requires accurate and timely information and advice from qualified staff with the skills to provide leadership and effectively implement decisions on policies and procedures.

The Assembly has strengthened its senior financial executive capacity and professional staff to support the Legislative Assembly Management Committee’s responsibilities and decisions.

The Legislative Assembly is implementing expanded internal controls to promote effective financial administration:

The Legislative Assembly aims to ensure that the Parliament Buildings are a safe and accessible place for those who work within and visit the Assembly. The Assembly has acted to ensure accessibility to the Parliament Buildings and strengthen emergency preparedness and business continuity planning. The Assembly has also moved to enhance access to Assembly information for Members and all British Columbians.

Work has been undertaken to ensure that all Members and British Columbians have accessibility to the Parliament Buildings. These changes supplement other accessibility initiatives, including the opening of the new barrier-free Mowat Entrance at the front of the main entrance of the Parliament Buildings in March 2013:

The Committee has overseen progress on the development of business continuity and emergency preparedness plans:

In 2013-14, the Legislative Assembly continued to increase the capacity of Members and British Columbians to access parliamentary information:

|

Hansard Broadcasting Services |

Since the May 14, 2013 election, the Legislative Assembly Management Committee has made progress in strengthening the Assembly’s financial and administrative management.

But the Committee also has more to do, including:

The Assembly will continue to develop new ways to ensure that British Columbians are served by good governance and the responsible use of taxpayers’ funds. The Committee has agreed that an independent Legislative Assembly Support Programs Accountability Review be undertaken to examine financial and administrative management, possible cost savings, and efficiencies that could be accomplished. This is the first time that such a review has been carried out at the Assembly, and its conclusions will inform the Committee’s work on the Assembly’s budget for the coming years.

Annual performance reporting is a good practice and a key means of conveying accountability to citizens. This Accountability Report highlights the work of Assembly administrative departments in: supporting the Assembly’s key functions to legislate, authorize expenditures and taxes, and undertake legislative oversight; delivering effective, responsible and accountable financial management and administration; ensuring that Members and British Columbians are well-informed about the work of their Legislative Assembly; and providing a safe and secure environment for Members, staff and citizens. Performance indicators measuring success in meeting goals are under development for reporting in the next Accountability Report.

Goal 1 |

The Legislative Assembly’s key functions to legislate, authorize expenditures and taxes, and undertake legislative oversight are supported. |

The Clerk of the Legislative Assembly is the senior permanent officer and procedural advisor to the Speaker and all Members. The Clerk directs Assembly management and staff in providing non-partisan services to the Assembly and Members. The Office of the Clerk produces House documents such as Orders of the Day and Votes and Proceedings, and is the repository for House documents and petitions. The Office provides exemplary, non-partisan procedural advice, and effectively, efficiently, and economically administers Assembly functions with an aim to be a jurisdictional leader in management, accountability, and procedural innovation.

Key activities in 2013-14 include:

|

Members of the Select Standing Committee on Public Accounts, |

Led by the Deputy Clerk and Clerk of Committees, the Parliamentary Committees Office supports the Clerk in providing procedural, operational, communications and research services to the Speaker and Members in order to assist the deliberative processes of the Assembly. The Office also provides procedural, administrative and research support to the Assembly’s parliamentary committees and their Members.

Key activities in 2013-14 include:

Goal 2 |

Effective, responsive and accountable financial management and administration. |

The Financial Services Department supports the Legislative Assembly through the provision of advice and services on Assembly budgets, financial management and planning, accounting, reporting, and administrative procedures.

Key activities in 2013-14 include:

The Human Resource Operations provides comprehensive personnel services across all of the Legislative Assembly’s departments. The work of the office is consistent with Public Service Agency classification policies and practices in other legislative jurisdictions. The office also provides ad hoc services and advice to Members and constituency offices on human resource issues.

Key activities in 2013-14 include:

Goal 3 |

Members and British Columbians are well-informed about the work of their Legislative Assembly. |

The work and decisions of the Legislative Assembly and its Members affect the lives of all British Columbians. The Assembly’s departments provide a range of information services to ensure that Members can meet their parliamentary responsibilities and to provide British Columbians with information on the Assembly’s parliamentary roles and proceedings.

Hansard Services supports the work of the Legislative Assembly by publishing the official reports of House and parliamentary committee proceedings and by producing live broadcasts and webcasts of those proceedings. The branch is committed to ensuring the work of Members is readily accessible to the public by distributing the broadcasts to the widest possible viewership and by quickly publishing the transcripts on line.

Key activities in 2013-14 include:

The Legislative Library provides documents and information services to support Members with their work. The Library develops a collection of materials to respond to the changing needs of Members in the Assembly, parliamentary committees, and constituency offices. The Library also delivers research and information services to Members, their staff, and the public on parliamentary and public issues.

Key activities in 2013-14 include:

|

BC Teachers' Institute on |

The Parliamentary Education Office provides information on the Assembly’s parliamentary roles and activities to Members and British Columbians. These services support Members with their representational responsibilities at the Assembly and in constituency offices, and enhance public awareness and understanding of the work of the Assembly and Members.

Key activities in 2013-14 include:In addition to providing committee procedural, operational, communication and research services as previously mentioned, the Parliamentary Committees Office provides timely and high-quality information on parliamentary committee activities to Members and British Columbians.

Key activities in 2013-14 include:

Goal 4 |

A safe and secure environment for Members, staff and citizens. |

Legislative Assembly security policies and operations ensure a safe and secure environment for Assembly deliberations, the work of Members and Assembly staff. The Sergeant-at-Arms is responsible for maintaining reliability and protection for the work of the Assembly, Members and staff, and manages the provision of building facility services for the Assembly, Members and British Columbians.

Key activities in 2013-14 include:

The Information Technology Branch provides reliable and secure information technology and support services to Members, their offices, and Assembly staff, and ensures accessible online Assembly information for citizens. The Branch uses flexible technologies to ensure that services are cost-effective, efficient and responsive to the changing needs of Members and citizens.

Key activities in 2013-14 include:

|

2011-12 |

2012-13 |

2013-14 |

Legislative Assembly Sitting Days |

67 |

32 |

57 |

Committee of Supply (Estimates) Sitting Days |

31 |

30 |

32 |

Bills Introduced |

73 |

55 |

37 |

|

|

|

|

Active Parliamentary Committees |

9 |

14 |

10 |

Active Committees Membership |

100 |

112 |

90 |

Parliamentary Committee Meetings |

83 |

120 |

85 |

Presentations to Parliamentary Committees |

293 |

477 |

305 |

Parliamentary Committee reports |

8 |

17 |

5 |

Parliamentary Committees website visits |

299,390 |

348,942 |

360,032 |

|

|

|

|

Hansard website visits |

Not available |

387,032 |

489,897 |

Hours of House and parliamentary committee broadcasts transcribed |

720 |

727 |

541 |

Library reference questions answered |

3,456 |

3,183 |

3,562 |

Library collection size at year-end |

418,015 |

433,369 |

448,292 |

Visitors on guided tours |

91,658 |

90,249 |

86,701 |

Guided school tours |

494 |

402 |

527 |

Educational resources provided to Members |

Not Available |

37,410 |

28,416 |

Statement of Financial Position Statement of Change in Net Debt Notes to the Financial Statements

|

||||

To the Members of the Legislative Assembly Management Committee, and We have audited the accompanying financial statements of the Legislative Assembly of British Columbia (“the entity”), which comprise the statement of financial position as at March 31, 2014, and the statement of operations and change in accumulated surplus, statement of change in net debt and statement of cash flows for the year then ended, and a summary of significant accounting policies and other explanatory information. Management's Responsibility for the Financial Statements Management is responsible for the preparation and fair presentation of these financial statements in accordance with Canadian public sector accounting standards, and for such internal control as management determines is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error. Auditor's Responsibility Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with Canadian generally accepted auditing standards. Those standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor's judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity's preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity's internal control. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management, as well as evaluating the overall presentation of the financial statements. In our view, the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Opinion In our opinion, the financial statements present fairly, in all material respects, the financial position of the Legislative Assembly of British Columbia as at March 31, 2014, and the results of its operations, changes in its net debt and its cash flows for the year then ended in accordance with Canadian public sector accounting standards. Other Matters Without modifying our opinion, we draw attention to note 2(b) to the financial statements, which describes that the Legislative Assembly of British Columbia adopted Canadian public sector accounting standards on April 1, 2013 for the development of these financial statements, which represents the entity’s first set of stand-alone, annual financial statements. These standards were applied retroactively by management to the comparative information in these financial statements. We were not engaged to report on the comparative information, and as such, it is unaudited.

|

|||||||||

The accompanying notes are an integral part of these financial statements.

Authorized for issue on the 6th day of November 2014, on behalf of the Legislative Assembly Management Committee.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The accompanying notes are an integral part of these financial statements.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The accompanying notes are an integral part of these financial statements.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The accompanying notes are an integral part of these financial statements.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The Legislative Assembly of British Columbia (Legislative Assembly) is a self‐governing, parliamentary institution established under the provincial Constitution Act, R.S.B.C. 1996. Its 85 Members of the Legislative Assembly (MLAs) are elected by popular vote to represent a constituency in a provincial general election held every four years. The main functions of the Legislative Assembly are: to consider, debate and approve legislation; to consider and approve all financial expenditures by government; and, to provide general oversight of the policies, plans and actions of the executive branch of government. The Legislative Assembly Management Committee (LAMC) is the statutory governing body of the Legislative Assembly and oversees its financial management and administration on behalf of Members of the Legislative Assembly (Members) and British Columbians. Chaired by the Speaker, LAMC is comprised of Members representing the government and opposition parties. Both LAMC’s and the Speaker’s administrative and oversight responsibilities are derived from the Legislative Assembly Management Committee Act. The Clerk is the senior permanent officer and procedural advisor to the Speaker and all Members, with responsibility for the administration and financial management of the Assembly. The position directs Legislative Assembly management and staff in the provision and delivery of non-partisan services to Members of the Legislative Assembly. Legislative Assembly departmental staff provide non-partisan services and support required by MLAs to fulfil their parliamentary duties while serving the Legislative Assembly and providing continuity from one Parliament to another. Advice and support are provided through a wide variety of services such as procedural, legislative, information technology, facilities management, library, educational, security, financial and food services. (a) Basis of accountingThese financial statements have been prepared in accordance with Canadian public sector accounting standards (PSAS). The amounts shown in these financial statements may not be consistent with the amounts presented in the Province of BC’s Public Accounts due to the various adjustments required to create stand-alone, non-consolidated financial statements. (b) Adoption of Public Sector Accounting StandardsPublic sector accounting standards have been adopted for the development of these financial statements, which represent the Legislative Assembly’s first set of stand-alone, annual financial statements. The Legislative Assembly has early adopted the accounting standards contained in PS 1201 – Financial statement presentation, PS 2601 – Foreign currency translation and PS 3450 – Financial instruments in the preparation of these financial statements. (c) InventoriesInventories held for sale are recorded at the lower of cost or net realizable value. Cost includes the original purchase cost plus shipping costs. Net realizable value is the estimated selling price less any costs to sell. This category of inventory includes gift shop and dining room inventory. Inventories held for use are valued at the lower of replacement value and cost, which includes the original purchase cost plus shipping costs. This category of inventory includes bulk purchases of carpeting to be installed in the Parliament Buildings and educational resources developed for public distribution. (d) Due from the Consolidated Revenue FundAmounts due from the Consolidated Revenue Fund (CRF) are the result of timing differences at year-end, and represent the net cash that the Legislative Assembly is entitled to draw from the CRF to discharge its liabilities without further appropriations. (e) Tangible capital assetsTangible capital assets (TCAs) are recorded at cost, which includes amounts that are directly related to the acquisition, design, construction, development, improvement or betterment of the assets. The Legislative Assembly only capitalizes TCAs that meet the acquisition cost thresholds defined in its policy manual, which is based on the Province of B.C.’s Core Policy and Procedures Manual (CPPM). The acquisition cost, less residual value, of the tangible capital assets, excluding land, is amortized on a straight-line basis over their estimated useful lives as follows:

The CPPM is available on the Ministry of Finance website and provides descriptions of these asset classes. Amortization for assets under construction does not begin until the asset is available for use. Tangible capital assets are written down when conditions indicate that they no longer contribute to the Legislative Assembly’s ability to provide goods and services, or when the value of future economic benefits associated with the tangible capital assets are less than their net book value. Tangible capital asset write-downs are accounted for as expenses in the statement of operations. Under PSAS, intangible assets, works of art, and historical treasures are not recognized in the financial statements. Leases which transfer substantially all of the benefits and risks of property ownership are accounted for as capital leases. All other leases are accounted for as operating leases and the related payments are charged to expenses as incurred. The Legislative Assembly does not have any capital leases at this time. (f) Prepaid expensesPrepaid expenses include such things as monthly MLA constituency office allowances and constituency office leases, and other service payments that will be charged to expense over the periods the Legislative Assembly is expected to benefit from them. (g) Accrued obligations to employees

Employee vacation time and banked overtime are accrued as earned and reduced when taken or paid out. Associated employee benefit costs are included in the accrual. The accrual is adjusted to reflect current pay rates. Additional information is provided in note 6. Regular employees who retire and who are scheduled to receive a pension under the Public Service Pension Plan are granted a full vacation entitlement for the final calendar year of service, regardless of the retirement date. In these cases, a full vacation entitlement is accrued on the employee’s last day of work.

The employee retirement allowance is accrued and recorded as expense in the fiscal year in which employees become eligible to receive the allowance. Additional information is provided in note 6. (h) Pension plans

The employees and Members of the Legislative Assembly belong to the B.C. Public Service Pension Plan, which is a multi-employer joint trustee plan. This plan is a defined benefit plan, providing a pension on retirement based on age at retirement, length of service, and highest average earnings. Inflation adjustments are contingent upon available funding. As the assets and liabilities of the plan are not segregated by institution, the plan is accounted for as a defined contribution plan. Contributions made by the Legislative Assembly are expensed as incurred.

Unfunded pension liabilities of the Members of the Legislative Assembly Superannuation Account represent the terminal funding that would be required from the province for the difference between the present value of the obligations for future benefit entitlements and the amount of funds available in the account. Additional information about Pension plans is provided in note 7. (i) Transitional assistanceTransitional Assistance is recorded as an expense in the fiscal year in which the former MLA was defeated in a provincial general election or chose not to run. Funds provided to former MLAs for the Career Retraining Allowance are expensed in the fiscal year in which the retraining occurred. Management records an estimated liability at year-end for the remaining transitional assistance payments. Additional information is provided in note 8. (j) Financial instrumentsThe Legislative Assembly does not hold any derivatives or equity investments and has not elected to record any other financial instruments at fair value. Financial assets and financial liabilities are measured at cost or amortized cost, less any permanent impairment in value. A statement of remeasurement gains and losses is not presented as the Legislative Assembly did not have any remeasurement transactions to report. (k) Revenue recognitionAppropriations used to purchase non-financial assets (tangible capital assets, prepaid expenses, and inventories held for use) are recognized as revenue when these assets are purchased. All other appropriations are recognized as revenue in the period in which the underlying expense occurs. Dining Room and Gift Shop sales are recorded as revenue in the period in which the services or goods were provided. (l) ExpensesExpenses are reported on an accrual basis. The cost of all goods consumed and services received during the year is expensed, regardless of when payment is made. (m) Foreign currency translationForeign currency transactions are translated at the exchange rate prevailing at the date of the transactions. (n) Measurement uncertaintyThe preparation of the financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities, at the date of the financial statements and the reported amounts of the revenues and expenses during the period. Items requiring the use of significant estimates include the tangible capital asset opening balances, the useful life of tangible capital assets, the employee retirement allowance, the MLA unfunded pension liability, and the MLA transitional assistance liability. An assessment of our opening capital asset and equity balances was completed in order to prepare this first set of financial statements. This process involved the use of estimates and professional judgement, as is further discussed in notes 11 (e) and (f). Estimates are based on the best information available at the time of preparation of the financial statements and are reviewed annually to reflect new information as it becomes available. Where actual results differ from these estimates and assumptions, the impact is recorded in future accounting periods when the difference becomes known.

The Legislative Assembly bank account maintains a zero balance throughout the year. As payments are made, the Ministry of Finance deposits the Legislative Assembly’s voted appropriation into the account to bring the account balance to zero. The majority of the Legislative Assembly’s receivables are due from provincial ministries and Members of the Legislative Assembly. All receivables are expected to be collected and are current (less than 30 days outstanding). As such, no provision for doubtful accounts has been recorded.

(a) Accounts payable and accrued liabilitiesThis account contains amounts payable to suppliers, and payroll remittances for Employment Insurance, the Canada Pension Plan, and income tax. (b) Salaries and benefits payableThis account contains salary and benefits amounts payable to employees and MLAs at fiscal year-end due to the timing of the biweekly payroll schedule. For fiscal 2014, one week of work was unpaid as at March 31. (c) Unreleased minister salary holdbacksA 20% holdback is applied to minister salaries as required by the Balanced Budget and Ministerial Accountability Act. The reduced salary amounts may be paid to the ministers after the Province of B.C.’s Public Accounts for the fiscal year are released, depending on whether collective and individual targets are achieved. As the Public Accounts are released after the Legislative Assembly’s fiscal year-end, an accrual is necessary to record the amount of ministerial salary withheld during the fiscal year that became payable after March 31, 2014.

(a) Employee leave liabilityEligible employees receive an annual vacation entitlement which increases with length of service. One-twelfth of the annual entitlement is earned by the employee each month, and a minimum of fifteen days of current year vacation must be used each year. Employees who have unused vacation days for an employment year may have the unused vacation paid out or carried forward for use in the following year. The employee leave liability amount contains current year vacation earned and not yet taken to March 31, 2014, vacation hours carried forward from the previous years, and banked overtime hours. Constituency assistants are employees of individual MLAs, and not employees of the Legislative Assembly. Their leave, therefore, is not included in this accrual. Similarly, MLAs do not accrue vacation time. (b) Employee retirement allowanceA retirement allowance is payable upon retirement to employees who have completed five or more years of combined service with the Legislative Assembly and the B.C. Public Service (with no break in service), are at least 55 years of age, and who are scheduled to receive payments from the B.C. Public Service Pension Plan. The retirement allowance is calculated based on the employee’s years of contributory service and basic salary at retirement. The minimum number of days of retirement allowance payable is 11 days (for those who have worked 5 years) and the maximum is 65.25 days (for those who have worked 30 or more years). Retirement allowance payments to seven former employees, totalling $45 thousand, were made in fiscal 2014 (Payments totalling $12 thousand were made to two former employees in fiscal 2013). (a) B.C. Public Service Pension PlanThe Legislative Assembly, the majority of its employees, and MLAs contribute to the B.C. Public Service Pension Plan (the Plan). The Plan is a multi-employer, defined benefit, and joint trusteeship plan, established for certain B.C. public service employees. Benefits, such as group health benefits and inflation protection for the basic pension, are not guaranteed and are contingent upon available funding. No unfunded liability exists for the future indexing of pensions as the obligation is limited to the amount of available assets in separate inflation accounts. In joint trusteed plans, control of the plans and their assets is assumed by individual pension boards made up of plan employer and plan member appointed trustees. The B.C. Public Service Pension Board of Trustees (the Board) is fully responsible for the management of the Plan, including investment of the assets and administration of the Plan. The Pension Corporation provides benefit administrative services and the British Columbia Investment Management Corporation provides investment management services as agents of the Board. In the event an unfunded liability is determined by an actuarial valuation (to be performed at least every three years), the Board is required to address it through contribution adjustments shared equally by Plan members and employers. It is expected, therefore, that any unfunded liabilities in the future will be short–term in nature. The Plan is a multi-employer contributory pension plan. Basic pension benefits are determined using a formula which takes into account years of service and average earnings at retirement. Pension benefits vest after three years for regular employees and after six years for MLAs. The Plan has about 56,000 active Plan members and approximately 41,000 retired Plan members. The latest actuarial valuation, as at March 31, 2011, indicated a $226 million funding deficit for basic pension benefits. The next valuation will be as at March 31, 2014 with results available in early 2015. Employers participating in the Plan record their pension expense as the amount of employer contributions made during the fiscal year (defined contribution pension plan accounting). This is because the Plan records accrued liabilities and accrued assets for the Plan in aggregate and as a result there is no consistent and reliable basis for allocating the obligation, assets, and cost to individual employers participating in the Plan. During the year ended March 31, 2014, the Legislative Assembly contributed $1.92 million to the Plan on behalf of its employees ($1.87 million during the year ended March 31, 2013). The Legislative Assembly’s contribution is 9.43% of each employee’s base salary up to the maximum pensionable earnings amount, and 10.93% afterwards (employees contribute 7.93% and 9.43%). During the year ended March 31, 2014, the Legislative Assembly contributed $3.97 million to the Plan on behalf of MLAs ($3.96 million during the year ended March 31, 2013). The current contribution rate to the Plan on behalf of MLAs is 39.48% of salary; each MLA contributes 11% of their salary. MLA participation in the Plan was established in 2007 (effective on or after June 19, 1996) by Part 3 of the Members’ Remuneration and Pension Act and based on recommendations made by the April 2007 Report by the Independent Commission to Review MLA Compensation. MLAs previously participated in a separate plan which is discussed below in note 8 (b). (b) Members of the Legislative Assembly Superannuation AccountThe Legislative Assembly Superannuation Account (the Account) was established under Part 2 of the Members’ Remuneration and Pension Act (the Act). The Account is administered by the British Columbia Pension Corporation (Pension Corporation). The Act was amended in July 1995 to discontinue the accrual of benefit entitlements under Part 2 after June 19, 1996. As eligible MLAs retire, the present value of the amount required to provide an MLA’s future pension benefit is transferred from the Account to the B.C. Public Service Pension Plan (the Plan). Pension payments are then paid from the Plan. The Legislative Assembly provides additional funding when the present value of the liability exceeds the accumulated assets in the Account available to fund those MLAs' benefit entitlements. The Act provides basic pension benefits for MLAs based on length of service, highest four–year average earnings and plan members' age at retirement. Benefits, such as group health benefits and inflation protection for the basic pension, are not guaranteed and are contingent upon available funding. A total of $478,000 was transferred from the Account to the Plan for two MLAs who began receiving their pensions in fiscal 2014. In the same year, the Legislative Assembly contributed $375,000 in terminal funding to the Account to meet future pension obligations. There are six MLAs eligible to receive a future pension benefit funded by the Account. As they retire, the Legislative Assembly will need to contribute $2.2 million to the B.C. Public Service Pension Plan. There is $0.5 million in the Account to cover this required funding so the net liability to the Legislative Assembly is $1.7 million ($2 million in fiscal 2013). Employment as an MLA is not considered insurable employment; therefore, MLAs are not eligible to contribute to the federal Employment Insurance plan. Instead, transitional assistance is available to MLAs who choose not to stand for re-election or who are defeated in a provincial general election. To qualify for transitional assistance, MLAs must complete their term of office in a parliament. MLAs who resign, forfeit their seat, or pass away during a parliament are not eligible for this assistance. For eligible MLAs, transitional assistance payments are based on the current MLA basic compensation rate ($101,859 annually). Transitional assistance continues to the date an MLA receives pension benefits or 15 months have elapsed. The assistance amount is taxable but not pensionable. Benefits coverage continues while former MLAs are in receipt of transitional assistance. To qualify for the full amount of transitional assistance, an MLA must have served a full term of parliament. Transitional assistance for an MLA elected in a by-election is prorated based on time served. MLAs in receipt of transitional assistance are responsible for notifying the Legislative Assembly of changes to their employment status. Transitional assistance payments are reduced by the gross amount of MLA reported employment earnings on a monthly basis. The total transitional assistance amount paid or payable to former MLAs as a result of the May 2013 election is estimated to be $3.6 million and was recorded as expense during the year ended March 31, 2014. Of this estimated total, $1.05 million had not yet been paid out as at March 31, 2014 and is recorded as a liability. MLAs eligible for the transitional allowance are also eligible for career counselling, education, and training costs up to $9,000 during the transitional assistance period. In total, approximately $50,000 was reimbursed to eight former MLAs for career retraining costs incurred during the year ended March 31, 2014. The Legislative Assembly may periodically be involved in legal proceedings, claims, and litigation that arise in the normal course of business. As at March 31, 2014, management is not aware of any claims or possible claims against the Legislative Assembly. Regular management and executive meetings are held in which operations are discussed and contingent liabilities are identified. In addition, management identifies contingent liabilities through review of day-to-day transactions, discussion with legal counsel, and by reviewing the meeting minutes of the Finance and Audit Committee, and the Legislative Assembly Management Committee. The Legislative Assembly is committed to minimum annual payments under various contracts for the delivery of services, the use of office equipment, and the rental of office space. MLAs lease office space throughout B.C. for their constituency offices. These leases are usually four years in length to coincide with the term of parliament. These contractual obligations are included below because they are paid for by the Legislative Assembly.

(a) Tangible Capital Asset Schedule - March 31, 2014

(b) Tangible Capital Asset Schedule - March 31, 2013 (unaudited)

(c) Work in progressAn asset under construction totalling approximately $4,000 (and $57,000 in 2013) has not been amortized. Amortization of this asset will commence when the asset is available for use. (d) Assets recognized at nominal valueDuring the year ended March 31, 2010, the Province of B.C. transferred 401 and 431 Menzies Street, both of which are on the parliamentary precinct, to the Legislative Assembly for a nominal value of two dollars. These buildings are recorded at their cost of one dollar each and are included in the buildings asset class. (e) Works of art and historical treasuresThe Legislative Assembly has an extensive library collection of historical books, government publications, newspapers, periodicals and pamphlets. Works of art and historical treasures are not recognized in the financial statements under PSAS. The replacement value of the collection is estimated to be $28 million as of the last appraisal on February 1, 2014. (f) Other assets not recordedThe land on which the Parliament Buildings are located is Crown land owned by the Province of B.C. and is not included in these financial statements. Management has made a best estimate of the opening tangible capital asset balance as at April 1, 2012; however, this estimate is subject to measurement uncertainty, especially for those balances relating to Parliament Building historical renovations. Construction of the Parliament Buildings began in 1893, with the central part of the main building opening in 1898. The cost was approximately $900,000. The east, west and library extensions were completed in 1914 at a cost of approximately $1.2 million. The Parliament Buildings are included in the tangible capital asset “buildings” category and are fully amortized. During the 1970’s and 1980’s, media reports note that the Legislative Assembly spent approximately $31 million on renovations to its buildings. Legislative Assembly historical financial records do not provide sufficient details to corroborate these expenditures and therefore we are unable to determine a reasonable estimate which would allow recognition of these amounts as tangible capital assets under public sector accounting standards. Consequently, these media reported amounts have not been recognized as tangible capital assets in the financial statements. If documentation had been available to corroborate the nature of these expenditures, the maximum estimated impact to the tangible capital asset balances as at March 31, 2014 would be an increase to the cost of buildings of $31 million, an increase to accumulated amortization of buildings of $25.7 million, and an increase to fiscal 2014 amortization of $775,000. The net book value for buildings would also increase by $5.3 million; however, this balance would be fully amortized within approximately seven years. The Legislative Assembly receives an annual appropriation (Vote 1 of the B.C. provincial Estimates) that includes an operating and capital component. Any unused appropriations lapse at the end of the fiscal year. The budgeted figures included in these financial statements are consistent with Vote 1 and have been provided for comparison purposes. The operating appropriation of $75.5 million is net of $0.5 million in budgeted revenues. Unlike most ministries and agencies, Vote 1 has statutory authority which provides for additional funding should costs exceed approved budgets due to unforeseen circumstances, such as increased length of sittings or additional work undertaken by parliamentary committees. The following table compares the Legislative Assembly’s actual expenditures to approved budgets:

The Legislative Assembly’s operating appropriation was higher in fiscal 2014 than in fiscal 2013 due to the anticipated additional costs associated with the 2014 election.

(a) Dining Room and Parliamentary Gift ShopThe Dining Room is a restaurant operated by the Legislative Assembly in the Parliament Buildings. It is open to MLAs, employees, and the public. The Legislative Assembly also operates a parliamentary Gift Shop. (b) Constituency office allowance recoveryMLAs are provided with an annual Constituency Office Allowance of $119,000 to operate their constituency offices. MLAs also receive $4,000 at the start of each parliament for furniture and equipment, and $2,000 ($1,000 for returning MLAs) for office start-up costs. The majority of the annual Constituency Office Allowance is used to pay the salaries of constituency assistants. In addition to the $119,000, the Legislative Assembly pays certain operating costs directly such as office leases, insurance, and IT costs. When an MLA leaves office, unspent constituency office funds are to be returned to the Legislative Assembly. The May 14, 2013 election resulted in a constituency office allowance recovery of $737,000 during the year ended March 31, 2014. (c) Recovery of prior year’s expensesA 20% holdback is applied to minister salaries as required by the Balanced Budget and Ministerial Accountability Act. The reduced salary amounts are paid to the ministers after the provincial Public Accounts for the fiscal year are released if collective and individual targets have been achieved. The Public Accounts are released after the Legislative Assembly’s fiscal year-end, resulting in a timing difference. In the year ended March 31, 2013, collective targets were not achieved resulting in a recovery of approximately $96,000 during the year ended March 31, 2014 ($98,000 for the year ended March 31, 2013). These amounts are included in the recovery of prior year’s expenses category. For the year ended March 31, 2013, this category also includes a recovery of previously expensed severance pay which was reduced when a former employee obtained a new job. The following is a summary of expenses by object:

MLAs’ allowances and expenses is comprised of constituency office leases, MLAs’ transitional assistance, the constituency office allowance, constituency assistant salaries, MLAs’ travel expenses, and other amounts. A detailed breakdown of MLAs’ travel expenses and MLAs’ constituency office allowance is available on our website. The total shown in this note contains amounts not included on our website, such as office lease and insurance amounts, which are paid for from the Legislative Assembly’s central budget.

The accumulated surplus balance is equal to the net book value of tangible capital assets (note 11). This is a result of our revenue recognition policy (note 2(k)). With the exception of tangible capital assets, revenues are recognized at the same time as the underlying expense to which they relate. In the case of tangible capital assets, revenue is recognized at the time the assets are purchased but the expense does not occur until the assets are amortized over their useful lives. As a result, accumulated surplus will change each year by the difference between tangible capital asset purchases and amortization. It is management’s opinion that the Legislative Assembly is not exposed to significant interest, liquidity, currency, or credit risk arising from its financial statements. The carrying values of financial assets and liabilities approximate their fair value because of their short maturity. The Legislative Assembly is self-insured. Any damage to Legislative Assembly property or equipment is paid for out of the Legislative Assembly’s operating and capital budgets. The Legislative Assembly pays an annual premium of $72,000 for a third party insurance policy covering MLA constituency offices. The Legislative Assembly is related to all Province of B.C. ministries, agencies, Crown corporations, school districts, health authorities, hospital societies, universities and colleges that are included in the provincial government reporting entity. Transactions with these entities, unless disclosed otherwise, occurred in the normal course of operations and are recorded at the exchange amount, which is the amount of consideration established and agreed to by the related parties. Examples of related party transactions conducted in the normal course of operations include printing fees paid to Queen’s Printer and heating services provided by the Ministry of Technology, Innovation, and Citizens’ Services. Management is not aware of any events subsequent to March 31, 2014 that impact these financial statements.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

© 2014 Legislative Assembly of British Columbia |