The Legislative Assembly of British Columbia

Report on the Budget 2016 Consultations

Select Standing Committee on

Finance and Government Services

First Report

4th Session, 40th Parliament

Table of Contents

Composition of the Committee

Terms of Reference

Executive Summary

Budget 2016 Consultation Process

K-12 Education

Advanced Education

Fiscal Policy

Health

Environment

Social Services

Natural Resources

Sport, Culture and Arts

Transportation and Transit

Public Safety

Summary of Recommendations

Appendix A: Public Hearing Witnesses

Appendix B: Written, Video, and Audio Submissions

Appendix C: Online Survey Respondents

November 13, 2015

To the Honourable

Legislative Assembly of the

Province of British Columbia

Honourable Members:

I have the honour to present herewith the First Report of the Select Standing Committee on Finance and Government Services for the Fourth Session of the 40th Parliament.

The Report covers the work of the Committee in regard to the Budget 2016 consultations, and was approved unanimously by the Committee.

Respectfully submitted on behalf of the Committee,

Wm. Scott Hamilton, MLA

Chair

Composition of the Committee |

|

MEMBERS

Wm. Scott Hamilton, MLA | Chair | Delta North |

Carole James, MLA | Deputy Chair | Victoria-Beacon Hill |

Dan Ashton, MLA | | Penticton |

Spencer Chandra Herbert, MLA

(from September 8, 2015) | | Vancouver-West End |

Eric Foster, MLA | | Vernon-Monashee |

Simon Gibson, MLA | | Abbotsford-Mission |

George Heyman, MLA | | Vancouver-Fairview |

Gary Holman, MLA

(to September 8, 2015) | | Saanich North and the Islands |

Mike Morris, MLA | | Prince George-Mackenzie |

Jane Jae Kyung Shin, MLA

(to September 8, 2015) | | Burnaby-Lougheed |

Claire Trevena, MLA

(to September 8, 2015) | | North Island |

John Yap, MLA | | Richmond-Steveston |

Clerks to the Committee

Kate Ryan-Lloyd, Deputy Clerk and Clerk of Committees

Susan Sourial, Committee Clerk

Research Staff

Lisa Hill, Lead, Committee Research Analyst

Aaron Ellingsen, Committee Researcher

Andrea Frost, Auxiliary Committee Researcher

Helen Morrison, Committee Research Analyst

On February 24, 2015, the Legislative Assembly agreed that the Select Standing Committee on Finance and Government Services be empowered:

- To examine, inquire into and make recommendations with respect to the budget consultation paper prepared by the Minister of Finance in accordance with section 2 of the Budget Transparency and Accountability Act [SBC 2000, c.23] and, in particular, to:

- Conduct public consultations across British Columbia on proposals and recommendations regarding the provincial budget and fiscal policy for the coming fiscal year by any means the committee considers appropriate;

- Prepare a report no later than November 15, 2015 on the results of those consultations; and

- To consider and make recommendations on the annual reports, rolling three-year service plans and budgets of the following statutory officers:

- Auditor General

- Chief Electoral Officer

- Conflict of Interest Commissioner

- Information and Privacy Commissioner

- Merit Commissioner

- Ombudsperson

- Police Complaint Commissioner

- Representative for Children and Youth; and

- To examine, inquire into and make recommendations with respect to other matters brought to the Committee’s attention by any of the Officers listed in 2 (a) above.

- To be the Committee referred to in the sections 19, 20, 21 and 23 of the Auditor General Act, S.B.C. 2003, c. 2 and that the performance report in section 22 of the Auditor General Act, S.B.C. 2003, c. 2, be referred to the Committee.

In addition to the powers previously conferred upon the Select Standing Committee on Finance and Government Services, the Committee shall be empowered:

- to appoint of their number one or more subcommittees and to refer to such subcommittees any of the matters referred to the Committee;

- to sit during a period in which the House is adjourned, during the recess after prorogation until the next following Session and during any sitting of the House;

- to adjourn from place to place as may be convenient; and

- to retain personnel as required to assist the Committee,

and shall report to the House as soon as possible, or following any adjournment, or at the next following Session, as the case may be; to deposit the original of its reports with the Clerk of the Legislative Assembly during a period of adjournment and upon resumption of the sittings of the House, the Chair shall present all reports to the Legislative Assembly.

This year’s public consultations on the provincial budget began on September 15, 2015 with the release of the “Budget 2016 Consultation” paper by the Minister of Finance. Over an approximately five-week period, the Select Standing Committee on Finance and Government Services (the Committee) held in-person public hearings in eight communities across the province. The Committee greatly appreciates and values the opportunity to travel in order to connect in person with individuals and organizations in communities in all regions of the province. To accommodate the fall sitting of the Legislative Assembly, which began on September 28, the schedule of community public hearings was adapted through the expanded use of teleconference and video conference facilities, including Skype, to connect with presenters in communities around B.C. The Committee hosted five of these virtual public hearings. The Committee also invited written, video, and audio submissions, as well as responses to an online survey. In total, 572 submissions were received by the October 15, 2015 deadline for public input. Copies of submissions made to the Committee during the budget consultation process are available upon request from the Parliamentary Committees Office.

This report summarizes key themes from the consultations, and makes 63 recommendations for the provincial government to consider for Budget 2016. All of the recommendations were unanimously agreed to by Committee Members. British Columbians expressed the need to focus on some high-level priorities, including: the need for balanced budgets, addressing the high cost of housing and rental accommodations, restoration of Adult Basic Education funding, adequate funding for K-12 education, strategic investment in the natural resource sector while maintaining environmental biodiversity and ecosystem health, support for provincial credit unions, increased funding and services for those most in need, and continued investment in provincial infrastructure.

A number of recommendations included in this report are ones that the Committee wishes to reiterate from budget consultation reports that relate to the Budget 2014 and 2015 Consultation processes. References to recommendations from previous years’ reports are noted in parentheses at the end of each recommendation, including the year and recommendation number. Feedback and submissions received during this year’s consultation process provided information that substantiates the reiteration of these recommendations, as they address issues that remain on the minds of British Columbians.

Recommendations in the area of fiscal policy affirm the desire to maintain balanced budgets, and include ways to support B.C. businesses and entrepreneurs as drivers of economic growth, and ways to generate additional government revenues through review of existing taxation mechanisms. The section on natural resource development proposes measures to promote and enhance B.C.’s valuable natural resource sector. Suggestions are also made to promote B.C.’s technology sector, and to renew efforts to promote clean energy, address climate change, and protect the environment, including biodiversity and ecosystem health.

Several recommendations are made in the areas of health and education. They include recommendations that focus on increased funding for programs and services for those who face mental health challenges, including children and youth, as well as focus on hospice and bereavement programs, the HPV vaccine and the health impacts of sugar-sweetened beverages. Recommendations related to education include funding for operations and capital expenditures, as well as literacy, Adult Basic Education and English as a Second Language programs, student grants and skills training to maintain B.C.’s competitive edge.

The Committee makes recommendations related to social services to assist B.C. families and to target resources towards those in need, and also support for arts and culture groups, whose submissions outline the important social and economic benefits that the arts bring to B.C. communities. Finally, there are a number of recommendations that relate to transportation and public safety priorities, including increased funding for transportation infrastructure, public transit and alternative justice models.

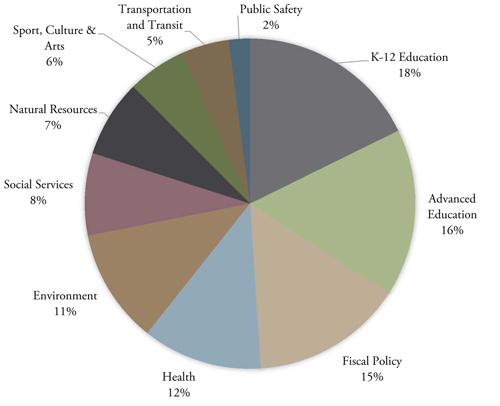

Topics within the report are ordered to reflect the magnitude of recommendations received on each topic, and are displayed from the most to the fewest, according to the overall number of submissions (including in-person presentations and written or video submissions) received related to a particular topic. The chart below summarizes the topics that arose throughout the consultation process. Sub-topics within topics are organized alphabetically and the recommendation(s) for each topic are ordered to align with the alphabetical organization of the sub-themes. The order of recommendations in the report is not intended to suggest priority.

Budget 2016 Consultation Process |

|

Section 2 of the Budget Transparency and Accountability Act requires the Minister of Finance to make public a budget consultation paper by September 15 each year. The paper must include a fiscal forecast, key issues to be addressed in the next provincial budget, and information on how members of the public may provide their views on those issues. Upon its release, the paper stands referred to the Select Standing Committee on Finance and Government Services (the “Committee”). The Committee then conducts consultations as it considers appropriate, and must make public a report on the results of those consultations by November 15.

Budget Consultation Paper

Released on September 15, 2015, this year’s paper, “Budget 2016 Consultation,” outlined the B.C. government’s commitment to balanced budgets, built on modest economic growth, prudent forecasts, and strong expenditure management. The paper described how a balanced budget helps keep B.C.’s debt affordable and how the province’s triple-A credit rating saves taxpayers millions of dollars, which frees up money to continue to support government programs. The paper additionally outlined information about lower taxes and new tax credits for British Columbians, supports to promote housing affordability, increased health care funding and investments in education and skills development. British Columbians were invited to participate in the consultations by ranking responses to four questions and providing input on options for government to consider to help make housing more affordable for those most in need without hurting families that already own a home. The questions and an analysis of responses are presented here ».

Finance Minister's Briefing

The Minister of Finance, Hon. Mike de Jong, Q.C., MLA, appeared before the Committee on September 15, 2015, to discuss the budget consultation paper and first quarterly report for 2015/16. During the presentation, the Finance Minister stated that the budget for 2015/16 is forecast to have a surplus of $277 million, a moderate decrease of $7 million from the $284 million surplus projected in February. Provincial sales taxes and property transfer taxes are increasing over the forecast amount, with property transfer taxes $200 million more than originally projected. The fiscal plan also includes $380 million forecast in statutorily required spending as a result of forest fire suppression.

Committee Members heard how B.C.’s debt as a percentage of GDP has decreased and that rating agencies are also looking at debt-to-revenue as another measurement being considered to determine economic health in a jurisdiction. In relation to the provincial economic outlook, the Finance Minister reported that the province’s labour market is growing, with job growth forecast to increase by 0.7 percent in 2015 and unemployment remaining well below the national average.

The Finance Minister reported that the provincial government’s objective to fully eliminate the direct operating debt by 2019-2020 is on target. If this happens, this would be the first time since 1975-76 that the B.C. government has not had a direct operating debt. He concluded the presentation with a brief summary of other key economic indicators, such as global economic conditions, including those in China and Asia, as well as commodity and financial market volatility.

Consultation Methods

Several methods were used to collect public input on budget 2016 recommendations, including community public hearings, written, audio, and video submissions, and an online survey. The Committee’s landing page was updated for the consultation process, and information on how to participate was publicized in a number of ways, including through the use of print, online and social media.

On August 27, 2015, a province-wide news release was issued announcing the Committee’s consultation plans and the locations of the public hearings. Newspaper advertisements were also placed in major provincial and community newspapers. A second province-wide news release was distributed on September 15, 2015 announcing the start of the consultation process and how to participate.

The work of the Committee was also promoted through social media. Regular updates and announcements of Committee activities were posted through Facebook and Twitter. Facebook advertisements were also used to invite submissions and to increase public awareness of the consultations.

Public Hearing Presentations

During the consultation period, the Committee held a series of public hearings, including eight sessions in communities around the province. To accommodate the fall sitting of the Legislative Assembly, which began on September 28, the schedule of community public hearings was adapted through the expanded use of teleconference and video conference facilities, including Skype, to connect with presenters in communities around the province. The Committee hosted five of these virtual public hearing presentations.

In total, the Committee heard 197 oral presentations from individuals and a range of organizations representing business, industry, community service providers, local government, labour, and other sectors. The list of the presenters from the public hearings is available in

Appendix A.

Written and Video Submissions

Over the course of the consultations, 156 written submissions and one video submission were received through the online submission form on the Committee’s website, by lettermail, or by fax. The names of all individuals and organizations that made a written or video submission are listed in Appendix B.

Online Survey Responses

A total of 218 individuals and organizations completed the online survey containing questions from the budget consultation paper. All of the online survey respondents are listed in Appendix C.

The budget consultation paper asked British Columbians to rank responses to four questions in order of priority and to provide input on options for government to consider to help make housing more affordable for those most in need without hurting families that already own a home. The questions and a tally of responses, along with graphical representations of the data are provided below:

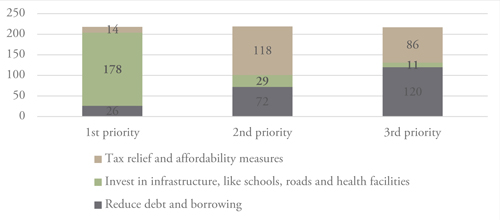

- British Columbia is one of the very few jurisdictions in the world with a budget surplus and a triple-A credit rating—which helps reduce government borrowing and keeps debt affordable. A budget surplus gives the government flexibility to make choices. Using a ranking of 1 (most important) to 3 (least important), how should the government prioritize the flexibility these surpluses offer?

| 1st Priority | 2nd Priority | 3rd Priority |

Reduce spending | 26 | 72 | 120 |

Invest in infrastructure, like schools, roads and health facilities | 178 | 29 | 11 |

Tax relief and affordability measures | 14 | 118 | 86 |

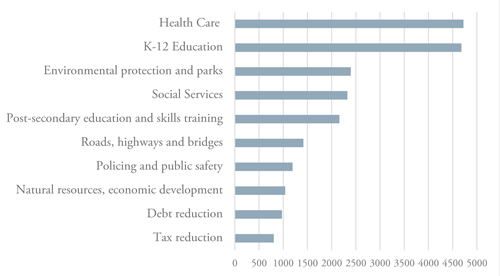

- B.C. is working to protect priority services and keep life affordable for families within a balanced budget and declining debt burden. If you had one dollar in new funding to share across programs and services the government delivers, how would you divide it up?

| $ allotted |

Health care | 4,723 |

K-12 education | 4,679 |

Environmental protection and parks | 2,396 |

Social Services | 2,325 |

Post-secondary education and skills training | 2,160 |

| Roads, highways and bridges | 1,416 |

| Policing and public safety | 1,193 |

| Natural resources, economic development | 1,041 |

| Debt reduction | 973 |

| Tax reduction | 804 |

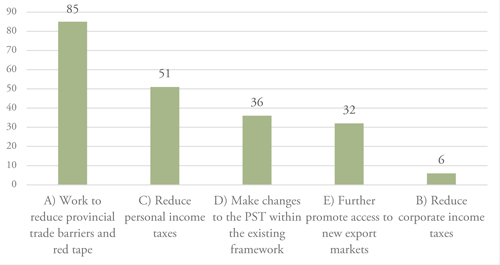

- British Columbia has one of the most diversified economies among the Canadian provinces. How should we continue our work to make job-creating industries more competitive? (Choose your top priority)

| # top

priority |

- Work to reduce provincial trade barriers and red tape

| 85 |

- Reduce corporate income taxes

| 6 |

- Reduce personal income taxes

| 51 |

- Make changes to the PST within the existing framework

| 36 |

- Further promote access to new export markets

| 32 |

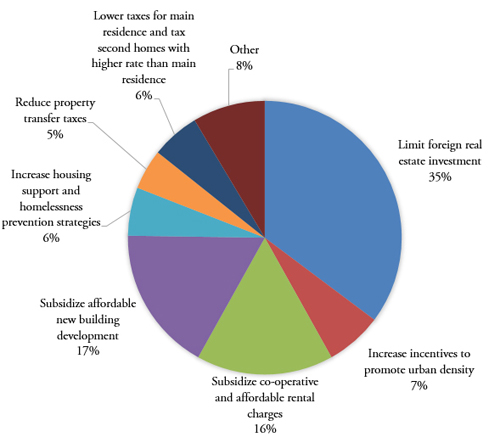

- What options could government consider to help make housing more affordable for those most in need without hurting families that already own a home? (Choose your top priority)

| # top

priority |

- Enhance assistance for first-time homebuyers

| 61 |

- Further encourage new construction to add to the housing supply

| 38 |

- To increase affordability without negatively impact families that already own a home, government could [fill in the blank]

| 116 |

*Top themes for suggestions provided through option “C” above:

Meetings Schedule

During the consultation period, the Committee held a series of public hearings, including eight sessions in communities around the province. To accommodate the fall sitting of the Legislative Assembly, which began on September 28, the schedule of community public hearings was adapted through the expanded use of teleconference and video conference facilities, including Skype, to connect with presenters in communities around the province. The Committee hosted five of these virtual public hearings.

Date |

Type |

Location |

March 11, 2015 | Organizational Meeting | Victoria |

September 15, 2015 | Minister’s Briefing; Public Hearing | Victoria |

September 16, 2015 | Public Hearing | Castlegar

Kelowna |

September 17, 2015 | Public Hearing | Nanaimo

Kamloops |

September 21, 2015 | Public Hearing | Vancouver |

September 28, 2015 | Public Hearing

(teleconference, Skype, and in-person session: Delta) | Victoria |

September 29, 2015 | Public Hearing

(video conference, teleconference, and Skype session: Prince George) | Victoria |

September 30, 2015 | Public Hearing

(video conference, teleconference, and Skype session: Williams Lake, Terrace, Dawson Creek) | Victoria |

September 30, 2015 | Public Hearing

(teleconference, Skype, and in-person session: Abbotsford) | Victoria |

October 7, 2015 | Public Hearing

(video conference, teleconference, and Skype session: Fort St. John, Fort Nelson, Cranbrook, Quesnel) | Victoria |

October 13, 2015 | Public Hearing | Surrey |

October 14, 2015 | Public Hearing | Richmond |

October 22, 2015 | Deliberations | Victoria |

October 28, 2015 | Deliberations | Victoria |

November 4, 2015 | Deliberations | Victoria |

November 5, 2015 | Deliberations | Victoria |

November 10, 2015 | Deliberations | Vancouver |

November 12, 2014 | Deliberations; Adoption of Report | Victoria |

Submissions including recommendations for K-12 education constituted a significant portion of the public input on Budget 2016, with the highest overall number of submissions received for a single topic. The second question of the online survey asked “If you had one dollar in new funding to share across programs and services the government delivers, how would you divide it up?” Respondents allocated K-12 education a combined average of 22 cents out of every dollar, a joint outcome shared only with health spending. According to the results of this survey, no other area of expense exceeded K-12 education as a spending priority. With one third of written submissions highlighting a K-12 education-related recommendation, this is clearly an area of focus for many British Columbians.

School districts, teachers, advocacy organizations and members of the public made submissions highlighting the importance of allocating adequate government funding for a strong K-12 school system. Increased and sustained funding to ensure teachers have adequate classroom supports in place were frequent requests throughout written and oral submissions to the Committee. Investment in seismic and capital infrastructure, provision of sufficient learning support staff and financing for classroom supplies were also common emerging themes.

Capital Funding

The Committee heard from a large number of Boards of Education from across the province, through written submissions, in-person and video presentations. There were many recommendations aimed at the need for providing additional funding for seismic upgrades, increased maintenance and the provision of additional school facilities in certain locations. Additional and targeted funding was requested to address the needs of aging school facilities and to meet forecast demand for additional student placement across specific areas of the province.

The Board of Education for School District No. 38 (Richmond) presented to the Committee and elaborated on their focus for allocation of funding for seismic upgrades. They suggested it would be appropriate to take a broader perspective than only seismic mitigation within the scope of this program. Representatives from School District No. 38 stated that as many of the schools that receive seismic funding also have significantly aging electrical and mechanical infrastructure, it would be more cost efficient and provide for greater impact if these funding upgrades were done concurrently.

Other school boards and individuals added suggestions for creating a more streamlined and transparent process for the approval of major capital projects, as well as the need to consider recognition of international students in the capital funding formula.

General Funding

Over 50 written submissions were made to the Committee pertaining to the importance of providing ongoing, stable and predictable funding for the K-12 education system. Individuals wrote to the Committee expressing concerns regarding the lack of funding for basic school supplies in the classroom. Many stipulated additional support was vital for teacher-librarians and also to provide new and incremental funding to enable the effective implementation of the new curriculum.

The Committee heard from the British Columbia Principals’ and Vice Principals’ Association (BCPVPA), who represent the professional and employment interests of the province’s public school-based administrators with over 2,100 voluntary members. They illustrated the importance of adequate school district funding for the actual costs of statutory and contractual obligations related to benefits, the Canada Pension Plan, Employment Insurance and WorkSafeBC. Further, the BCPVPA recommended additional investment in leadership development to enable the Ministry of Education to develop a comprehensive program to recruit, retain and support professional learning. Other submissions echoed these requests, with repeated calls to review the compensation funding model for exempt staff.

Operational Funding

Corresponding to previous budget consultations, the Committee received a number of submissions on the topic of K-12 funding. Numerous boards of education, advocacy organizations, associations and individuals across the province presented or sent written submissions to the Committee requesting enhanced core funding.

The BC Teachers’ Federation (BCTF), which represents the province’s 41,000 public school teachers, reiterated its previous request for additional funding for K-12 education. The BCTF also requested public education funding be increased to ensure that the Teacher Education Fund is able to increase teaching staff to support areas of greater need.

The BC School Trustees Association, a professional body with branches across the province, presented to the Committee in Kelowna, stressing it is time for a detailed review of the current funding formula, particularly in relation to the exempt staff compensation freeze. This was a view shared by the majority of organizations and individuals presenting to the Committee on this topic. Other suggestions included a request to increase operating grants to bring levels up to the national average, as well as examining the funding ratio per student so that schools can continue to provide education in the face of existing funding pressures.

Special Needs

A large number of individuals wrote to the Committee with requests to consider prioritizing learning support in K-12 schools. Recommendations were made to maintain or increase funding for: Education Assistants, school counsellors, Learning Assistance teachers, English as a Second Language (ESL) staff, childcare workers, speech and language pathologists, integration support workers and school psychologists.

The Children, Youth and Families Advisory Committee (CYFAC), representing 21 members in Vancouver, wrote to the Committee outlining the importance of adequate support for students with special needs. Other submissions expanded on the additional supports required for these students, such as the possibility of reviewing the supplementary funding grants for students with special needs, with a view to increasing funds and targeting much needed support. Written submissions included requests to re-stabilize critical early childhood development programs, decrease wait times for support and assessment services, as well as to consider mandated training in behavioral supports for teachers, support staff, principals and all district administrators.

Conclusions

Aligning with the previous year’s requests for K-12 education, the Committee acknowledges the importance of providing adequate funding and support for this sector. The recommendations presented to the Committee from organizations and individuals across the province suggest current funding levels and assistance are inadequate, which is causing significant operational and program delivery problems in schools throughout B.C.

Three main recommendations are made for this sector. First, the Committee recommends that government ensure sufficient and timely capital funding to provide for facility improvements, seismic upgrades and also to facilitate the building of new schools in areas that are struggling to cope with increasing student numbers. The Committee ascertains that additional funding is necessary to ensure the provision of quality public education and to properly meet the increased costs that schools are currently facing.

Finally, the Committee recommends a review of the Ministry of Education funding formula relating to programs, services and administrative staffing compensation, to ensure this sector is properly supported. By properly investing in this sector, the Committee suggests that economic and community goals have a better chance of being realized.

Summary of Recommendations

The Committee recommends to the Legislative Assembly that the provincial government:

Recommendations |

- Provide adequate capital funding to school districts for facility improvements, seismic upgrades and additional schools in rapidly-growing communities. (2013: #25 and 2014: #23)

- Provide stable, sustainable and adequate funding to enable school districts to fulfil their responsibility to continue to provide access to quality public education, with recognition of the increased costs that school districts have incurred. (2014: #22)

- Review the Ministry of Education funding formula for programs and services, as well as administrative staff compensation levels to ensure adequate and competitive compensation.

|

|

Submissions on post-secondary education constituted a large portion of the public input on Budget 2016. The second question of the online survey asked “If you had one dollar in new funding to share across programs and services the government delivers, how would you divide it up?” Post-secondary education was allocated an average of 10 cents out of every dollar and also figured prominently in a large proportion of written and oral submissions. With such a high and constant response rate over the entire consultation period, advanced education is clearly a priority that reaches across the entire province.

Colleges and universities, student unions, literacy outreach organizations, public library representatives, advocacy organizations, faculty associations and members of the public made submissions to the Committee on the topic of advanced education. The importance of relevant skills training to support the B.C. Skills for Jobs Blueprint, provide for First Nations students and meet the future requirements of the workplace were common emerging themes.

Recommendations put forth to the Committee included calls for increased budgeting for operating and capital needs, and multiple requests for a comprehensive review of the existing funding model. In addition, the Committee received a considerable number of submissions on topics focusing on literacy outreach, English as a Second Language (ESL) and Adult Basic Education (ABE) programs. Equitable access and affordability issues, and the necessity to address growing demands for post-secondary education in some regional areas were also highlighted.

Adult Basic Education and English as a Second Language

Many submissions that were sent to the Committee on the subject of Adult Basic Education (ABE) stressed the need for sustainable funding to be restored for the purpose of supporting ABE programs in B.C. Key representatives from universities and colleges, along with numerous individuals across the province, made submissions suggesting that the financial assistance given to these programs should be reinstated to the $6.9 million that had been previously allocated. The Committee acknowledges that ABE and ESL programs may be offered in educational institutions that provide either K-12 or advanced education curriculums.

Along with requests for funding for ABE, were a large number of submissions regarding funding for post-secondary programming for English as a Second Language (ESL). In Kamloops, the Committee heard from the Thompson Rivers University Faculty Association, an association that speaks on behalf of faculty staff who teach locally and at a number of regional centres. Among their suggestions was a need for an ongoing commitment of at least $22 million to support the provincially funded ESL programs which are delivered by B.C.’s post-secondary institutions.

Other topics of notable shared interest were the request to provide consistent, long-term funding for Aboriginal learners, access to support for upgrading education and also requests to enhance the funds to the Adult Upgrading Grant (AUG) program. The linkages to these programs and provincial requirements, as outlined in the BC Skills for Jobs Blueprint, were also highlighted by many educational institutions.

Capital funding

The Committee heard a presentation from the Student Association of the British Columbia Institute of Technology (BCIT Student Association) which outlined their recommendation to permit universities to engage in self-financing capital projects, such as building new residences on campus.

BC Colleges also presented to the Committee with a number of suggestions to enhance operating grants for capital improvements and infrastructure development. Their submission replicated a common focus emerging from a number of other representatives from student unions across the province. Many other colleges presented information to the Committee highlighting the need for increased investment to modernize information technology, add new instructional space and complete necessary seismic and energy-efficiency upgrades.

Specific requests were received from representatives of Simon Fraser University, asking the Committee to reiterate previous support for doubling the size of the SFU Surrey Campus. They asked that the Committee’s previous recommendations of 2011 and 2013, to expand the size of the SFU Surrey campus from 2,500 to 5,000 students be reiterated, to allow for the first phase of this expansion to commence in 2016.

General funding

In Richmond, the Committee heard from the Federation of Post-Secondary Educators of BC which represents the interests of faculty and staff at B.C. universities, colleges and institutions. Their presentation reiterated the common request to consider an extensive review of the post-secondary funding model to ensure funding is fair and equitable on a per-student basis. Additional shared suggestions included establishing a merit-based annual scholarship program for graduates and increasing the Aboriginal Services Plan (ASP) to allow additional support for Aboriginal students.

Numerous student unions submitted requests for university costs to be decreased by maintaining or reducing the 2 percent tuition cap for all programs. Other submissions asked for additional resources for provision of adequate open source ancillary teaching materials and textbooks. Specific programs that were mentioned as requiring additional stable and predictable funding included the BC Knowledge Development Fund and the BC Open Textbook Program.

Literacy programs

A large number of submissions were made to the Committee calling for annual funding for literacy coordination to facilitate community literacy programs and services. The Literacy Matters Abbotsford Task Group, who have membership from 14 community associations across Abbotsford and the Fraser Valley, made proposals that were reflected by other literacy outreach organizations across the province. They suggested that $2.5 million should be provided annually to continue to increase literacy rates in their communities. Decoda Literacy Solutions, which a provincial literacy organization that supports community-based literacy programs and initiatives in over 400 communities across B.C., presented to the Committee and echoed the requests heard by the Committee to ask government to provide dedicated funding for literacy programs.

Requests were made to ensure that the funding is maintained over multiple years, bringing stability to literacy work. The needs and long term benefits of improved literacy were reiterated by literacy outreach organizations, who highlighted the beneficial impact that their services provide, such as enabling people to participate in the workforce, and to participate fully in their community and society as a whole.

Operational funding

The request to allow institutions to access reserves over a multi-year window was another common theme emerging from many submissions. Universities submitted requests for a comprehensive analysis of deferred maintenance costs, asking for the development of a fiscal framework to enable them to deal with identified maintenance issues.

The BC Association of Institutes and Universities (BCAIU), representing seven post-secondary institutions in B.C., presented a written submission to the Committee, emphasizing the value of allowing access to financial reserves. They also elaborated on the benefits of removing the directive to balance financial performance on an annual basis.

The Research Universities’ Council of BC, representing the interests of the six major universities in B.C., presented to the Committee in Vancouver. They reiterated the importance of maintaining the province’s commitment to the BC Knowledge Development Fund while also providing some important context as to why it is important to commit to continued post-secondary funding. The linkages to sustained capacity and quality of post-secondary education to propel the regional economy forward was a key underlying theme in their suggestions, which included increasing the operating grant, reinvesting the $50 million that has been reduced over the last three years, and investing that amount in targeted areas.

Partnerships

Many submissions outlined the progress that has already taken place in the province with respect to working collaboratively across academic institutions, business and industry. There were some suggestions for ways in which partnerships could further be enhanced. Specific recommendations from education providers included the suggestion of allocating $3 million in one-time funding to help leverage B.C.’s portion of federal funding to support further innovation between universities and colleges, business and industry.

The Committee received a written submission from the University of British Columbia, who reiterated the comments of many other educational providers on this topic. They and other institutions welcome opportunities to work with sector partners and the Province to strategize how best to respond to skills shortages. By exploring system-wide solutions, they believe it is possible to foster a vibrant and financially sustainable post-secondary system to serve all British Columbians and continue to grow our economy.

Skills training

Specific skills shortages were mentioned in multiple submissions from colleges, universities and representatives from business and industry. There were many references to the need to make a multi-year investment plan to target investments and build capacity, allowing for programs to adapt to labour market demands.

Particular concerns were reported in trades, technology, and science and engineering programs. Representatives from universities, colleges and trade schools across the province suggested additional funding should be made available to develop and pilot new sector-wide courses specifically relating to the highest demand occupational areas. Other suggestions included setting aside funding for a targeted Completion Grant, over and above the existing completion grant, to provide further debt relief to students who complete a program in a field that has been designated as critical or in need by the Province.

Student grants

The Committee received a total of 13 submissions from university student unions, colleges and umbrella organizations detailing specific requests to implement needs-based student grants. A common message relayed was the damaging impacts that current funding pressures are having on post-secondary institutions, adding to challenges in providing access to affordable and meaningful education resources.

A range of potential solutions were brought forward. One of the Canadian Federation of Students’ suggestions, to consider reducing, or perhaps even eliminating interest on student loans altogether, emerged as a common request.

Conclusions

As in previous Finance and Government Service consultations, the importance of advanced education and funded programs for literacy is evidenced by the array of submissions presented to the Committee by individuals and organizations across the province. The ability to properly educate adults to allow personal fulfilment, to improve job prospects, and to facilitate economic stimulus, remains a top priority for British Columbians.

The concerns heard over long term funding in this area led the Committee to urge government to undertake a comprehensive review of post-secondary funding, including looking at current limitations to post-secondary institutions’ ability to self-finance capital projects. Support was also given to reviewing opportunities for increasing operating grants and funding for capital projects related to infrastructure, teaching materials and equipment. Reiterating recommendations contained in the 2014 report, the Committee also recommends government reaffirm the commitment to double the size of the SFU Surrey campus. Also consistent with 2014 recommendations, the Committee encourages government investment for continued community literacy and outreach work, as well as ongoing support for ABE and ESL programs. The Committee agrees that investment in this area would allow exponential benefits to the province, equipping communities to better meet immediate and future skills requirements and support a healthy economy.

Acknowledging the need for capacity building to meet demand for targeted skills training, the Committee recommended investment in a multi-year investment plan in this area. To ensure a properly trained workforce, the Committee also echoes its 2014 recommendation that government establish a student grant program that improves program accessibility and affordability for students.

Recommendations

The Committee recommends to the Legislative Assembly that the provincial government:

Recommendations |

- Restore full and sustained funding to the Adult Basic Education (ABE) and English as a Second Language (ESL) programs. 1(2013: #40 and 2014: #32)

- Provide funding support for capital projects related to infrastructure and equipment, such as building maintenance, renovations and projects related to seismic and efficiency upgrades. (2013: #25 and 2014: #29)

- Recommit to the MOU signed with SFU and the Province on March 10, 2006 to double the size of SFU Surrey from 2,500 to 5,000 student FTEs by 2015. (2013: #33)

- Address legislative, policy or other impediments that currently limit post-secondary institutions from financing self-supported capital projects. (2013: #31 and 2014: #31)

- Undertake a comprehensive review of the post-secondary funding formula so that regional inequities and core funding for the system as a whole are adequately addressed. (2013: #30 and 2014: #30)

- Provide support to enable more open source ancillary teaching materials and textbooks to be made available online to post-secondary research institutions, such as through the BC Open Textbook Program.

- Provide multi-year annual funding of $2.5 million to continue coordinated community literacy work. 2(2013: #29 and 2014: #46)

- Increase operating grants to post-secondary institutions to address unfunded cost pressures and move to multi-year allotments for operating grants and deferred maintenance grants to help these institutions with their financial planning. (2014: #27, #28)

- Commit to a multi-year investment plan to build capacity and meet demand for urgently-required skills training. (2013: #34)

- Establish a student grant program that addresses student needs and provides incentives for completion and review the interest charged on B.C. student loans and review existing eligibility requirements for student loans. (2013: #37, #38 and 2014: #34, #35)

|

|

1 This recommendation also relates to the K-12 Education topic in this report.

2 This recommendation also relates to the K-12 Education topic in this report.

The Committee heard from associations representing business, industry, accounting professionals and other sectors that offered recommendations around general fiscal policies and different areas related to taxation and government spending priorities.

In his presentation to the Committee regarding the release of the Budget Consultation Paper on September 15, 2015, the Minister of Finance outlined government’s priorities for debt reduction, greater infrastructure investment and tax and cost reductions. He additionally noted some of the questions raised in the budget consultation survey related to determining priorities among services, job creation and affordable housing. Specific submissions to the Committee looked at the Provincial Sales Tax (PST), Property Transfer Tax and the Carbon Tax.

Balanced Budgets and Debt Reduction

A variety of organizations and individuals presented to the Committee or sent written submissions that supported the commitment to a balanced budget in 2016 and expressed support for ongoing efforts dedicated to provincial debt reduction. With global markets still volatile in many areas and sectors, and economic uncertainties presenting challenges for governments, the desire for continued economic stability and realistic growth was a prevalent theme throughout the submissions and presentations received by the Committee. Recommendations that underlined government’s dedication to disciplined spending were expressed by many presenters.

Carbon Tax

A wide range of recommendations with differing viewpoints were brought to the Committee by a number of organizations and individuals in relation to the Carbon Tax. The Committee heard from representatives from several regional chamber of commerce organizations, including the British Columbia Chamber of Commerce and the Parksville and District Chamber of Commerce. Additionally, the Committee received presentations from Clean Energy Canada, the Canadian Centre for Policy Alternatives - BC Office, and a number of individuals who asked that government examine current policy related to the Carbon Tax and look at ways to ensure that the tax is performing in relation to the original intention to reduce greenhouse gas emissions.

Credit Unions

The Committee heard from a significant number of the 42 credit unions that encompass the credit union system in B.C., including Island Savings, Coastal Community Credit Union, Central 1 Credit Union and Coast Capital Savings Credit Union. Representatives from the organizations who took the opportunity to present an oral or written submission to the Committee came forward with a unified recommendation to ask that the current temporary deferment of the preferential tax rate be made permanent. The 2014 provincial budget called for the Income Tax Act to be amended to phase out the provincial preferential income tax treatment for credit unions over five years. The Committee heard how this change will cause the estimated effective tax rate on credit unions to rise considerably. It was additionally noted that if the preferential provincial tax rate for credit unions was removed, these organizations would pay a higher effective tax rate than chartered banks.

Representatives from the credit unions shared examples of local success stories with the Committee to illustrate the positive impact that credit unions can have in their communities through partnerships and sponsorships supporting not-for-profit and charitable organizations, as well as their relationships with small businesses and individuals. Many credit unions earmark a percentage of their pre-tax income to community investment, and the concern was expressed that this could be affected by increased taxes on credit unions in the future. The Committee wanted to ensure that their recommendation would be restricted to focus on B.C.-based credit unions and the B.C.-based operations of national credit union organizations.

Property Transfer Tax

Presenters from a variety of organizations, including the British Columbia Real Estate Association and the Canadian Homebuilders’ Association of BC put forward recommendations to the Committee related to the Property Transfer Tax and the Property Transfer Tax Act, and asked the Committee to consider a recommendation asking for a review of the tax, as well as associated legislation and policies, particularly related to threshold levels in relation to the current real estate market in B.C.

Several presenters suggested that the Committee might want to consider making a recommendation to government to review practices and policies from other jurisdictions that have examined property transfer taxes in relation to their growing real estate markets.

Provincial Sales Tax

The Committee heard from a number of organizations that represent the retail and professional accounting sectors, including the Canadian Federation of Independent Businesses, Retail Council of Canada, Business Council of British Columbia and the Chartered Professional Accountants of BC, who brought forward recommendations in relation to the implementation of the Provincial Sales Tax (PST).

Presenters noted that the PST can create some burden for businesses wanting to invest in capital infrastructure, such as equipment and machinery, and asked the Committee to recommend that government look at any anomalies related to capital expenditures that might exist in this area and examine opportunities to ensure improvements for businesses. Additionally, the Committee heard from the Vancouver Board of Trade and a selection of regional municipal organizations, who suggested that government should continue to explore policy or tax changes that would help to improve the competitiveness of B.C. businesses.

Technology, Research and Investment

The Committee heard from a number of organizations, including Genome BC and the LifeSciences British Columbia Society, that represent the technology and research sector, who came forward to present their ideas related to how government might continue to support ongoing advancement through collaboration with federal partners to attract and leverage venture capital investments through private sector and international investors.

Conclusions

As noted in the Budget 2016 Consultation paper, the B.C. government’s commitment to balanced budgets, built on modest economic growth, prudent forecasts, and strong expenditure management, has withstood ongoing global economic uncertainty. Many of the presentations and submissions heard and received by the Committee on the topic of fiscal policy and taxation echoes government’s priorities to maintain balanced budgets and work towards reducing debt over time.

The Committee acknowledges the challenges that businesses could face in regards to the Provincial Sales Tax (PST) and asks that the provincial government consider a review of the tax policy and how the tax is implemented to ensure that any anomalies and implementation challenges that might exist are addressed. The Committee appreciated hearing from a range of business-oriented organizations that represent small, independent and large-scale businesses during the consultation process and acknowledges that businesses are a major driver to ensuring the economic health of the province and continued growth.

As in the previous year, the Committee heard from a range of organizations and individuals who brought forward recommendations related to the Carbon Tax for the Committee’s consideration. In keeping with the original intent of the Carbon Tax to reduce greenhouse gas emissions, the Committee recommends that government consider a plan to apply the carbon tax to measurable carbon emissions which are currently omitted from coverage.

A number of organizations representing regional and provincial credit unions brought forward a unified recommendation to the Committee asking that the temporary tax deferral be made permanent. The Committee acknowledges the value that credit unions bring to small businesses and individuals and their communities, and puts forward a recommendation to government in regards to the credit unions’ request. The Committee heard from a number of citizens and organizations that there should be an opportunity for government to examine the Property Transfer Tax and associated policy and legislation to ensure that the tax is functioning as intended and that there are no areas where loopholes might exist. The Committee heard from gaming facility operators who presented information to the Committee related to gaming revenues, as well as capital investment opportunities to support job growth and economic activity.

Recommendations

The Committee recommends to the Legislative Assembly that the provincial government:

Recommendations |

- Remain committed to balanced budgets and continued debt reduction. (2013: #1, #2 and 2014: #1, #2)

- Consider a plan to apply the carbon tax to measurable carbon emissions which are currently omitted from coverage. (2014: #5)

- Make the temporary deferment of the preferential provincial tax rate for BC-based credit unions (and B.C.-based operations of national credit union organizations) permanent. (2013: #9 and 2014: #7)

- Review the Property Transfer Tax to look for opportunities to assist first-time homebuyers. (2013: #10 and 2014: #6)

- Take measures to mitigate the effects of property speculation on housing affordability. (2014: #6)

- Review the Provincial Sales Tax (PST) to address any existing anomalies that relate to business capital investment. (2013: #3 and 2014: #3)

- Work with Genome BC and the federal government to identify ways to leverage and attract funding from the private sector and international sources necessary to support a five-year genomics research and development program. (2014: #53)

- Work with the life sciences and technology sectors and the federal government, through the Venture Capital Action Plan and other mechanisms, to create a pool of venture capital that can leverage additional private sector capital for early stage companies. (2014: #52)

|

|

Health sector professional associations, community service providers, healthy living advocacy groups and interested citizens made submissions before the Committee on health-related topics this year. Presenters described health care service challenges facing individual communities and regions around the province in terms of capital and operational funding, and brought forward a range of resourcing requests to address specific health issues.

As has been the case in recent years, the Committee heard a number of presentations highlighting an important role for preventative measures in addressing population health issues, from mental health and addictions services, to children and youth mental health, to childhood obesity and improving access to the HPV vaccine. Several presentations addressed Medical Service Plan (MSP) affordability, and an important role for education — both for the public and for professionals — was brought to the Committee’s attention repeatedly as a key indicator for success in early assessment and treatment related to health concerns.

Hospice and Bereavement Programs

Committee Members heard presentations on behalf of numerous hospice societies regarding provincial funding support for hospice care and bereavement services, as well as the challenges faced by British Columbians as they near the end of life or provide care for others approaching end of life.

The Castlegar Hospice Society reminded Committee Members that only 16 percent to 30 percent of Canadians have access to tertiary or hospice palliative services, with limited availability in many regions. Further, the Committee heard, each death has serious impact on at least five people, many of whom could benefit greatly from increased availability of bereavement services. Because hospice beds cost approximately $300 per day, and acute care beds closer to $1000 per day, Committee Members heard, support for hospice palliative services should provide savings to the health care system.

The Fraser Health Region Hospice Advisory Committee (HAC) presented in Richmond on behalf of 11 region hospice societies. In its presentation to the Committee, HAC presented its case for two-year pilot funding for hospice societies’ bereavement services, as an effective means to support the Province’s goal to invest in palliative care and hospice services. The HAC highlighted for Committee Members the multiple ways such an investment can be leveraged by hospice societies in supporting the training of volunteers, increasing outreach to vulnerable groups, providing supports for clinical staff, and reducing the burden on stretched provincial health care system resources.

Human Papillomavirus Vaccine

The Committee heard support from a number of organizations for the Province’s human papillomavirus (HPV) vaccination program as an effective means to reduce incidence of certain cancers, including a growing number of oral cancers of the throat and tongue. Presentations addressing HPV vaccination programs by the Living Positive Resource Centre and the YouthCo HIV and Hep C Society were united in recommending that the program, currently aimed at young women and ‘at-risk’ men, be extended to include all young people. Merck Canada also voiced support for an expanded HPV vaccination program, pointing out that comprehensive vaccination programs support health care budget sustainability through prevention of future costs. Providing universal HPV vaccination for school-age boys and girls is current policy in Prince Edward Island, Alberta and Nova Scotia, and consistent with 2015 recommendations of the Public Health Agency of Canada’s National Advisory Committee on Immunization. Cost for the requested expansion of the provincial HPV vaccination program is estimated at $4 million.

Medical Services Plan

The Committee heard requests for a review of Medical Services Plan premiums from the Canadian Taxpayers Federation (CTF) during its presentation at the Surrey public hearing, with several individuals’ written submissions echoing a similar sentiment. While recognizing the revenue-generating importance of MSP premiums, the CTF pointed out that increasing rates have proven onerous for some families and seniors, and for businesses who pay through payroll contributions.

In terms of topics for review, submissions addressed equitability of rates for individuals and families, and creation of a designated health care fund where MSP premiums could be held. From a service providers’ perspective, Walk-in Clinics of BC requested increased flexibility in the MSP cap on the number of patients seen daily by MSP general practitioners.

Mental Health and Addiction Services

The Committee heard about the importance of funding to bolster mental health and addictions services from a range of service providers and advocacy organizations. The British Columbia Schizophrenia Society outlined their concerns about mental health care in the province, with high costs, delayed treatment and inadequate supports leading into substance abuse, homelessness, and crises requiring law enforcement and acute care intervention. The Canadian Mental Health Association emphasized the need for a balanced approach, incorporating community-based and acute care mental health supports and services, and suggested that investments in mental health acute care be matched by investments in community care.

Organizations including the B.C. Schizophrenia Society, the Prince George Mental Health Consumer Council, and the Vanderhoof MenShed Society made recommendations around program- and area-specific funding, following a theme of resourcing improved and expanded access to mental health and addictions services in the province, including additional community care options, as well as providing dedicated initiatives for early intervention and prevention.

Mental Health Services – Children and Youth

Several organizations focused comments to the Committee on an important role for early intervention in a healthy living strategy to ensure timely and coordinated mental health services and supports for children and youth in the province. The Canadian Mental Health Association emphasized that availability of services and programs for children and youth facilitates early identification of mental health issues, providing young people with the supports required to complete their education and ensure full participation in their communities. The British Columbia Healthy Living Alliance recommended doubling the funding for promotion of health and prevention of disease, ensuring disadvantaged youths, as well as other demographics, enjoy every opportunity to succeed.

Taxation on Sugar-Sweetened Beverages

Childhood obesity is a public health concern to British Columbians, and evidence suggests that overconsumption of sugar-sweetened beverages plays a significant role in increasing rates of childhood obesity. The Committee heard a range of perspectives from public health advocacy groups and industry associations on an appropriate role for government in respect to discouraging overconsumption of sugar-sweetened beverages.

The Childhood Obesity Foundation and the Canadian Diabetes Association voiced support for implementation of a volume-based tax on sugar-sweetened beverages, and suggested that revenue from such a tax be reinvested in initiatives to promote the health of British Columbians.

In contrast, the Western Convenience Store Association points to its active role in testing approaches to encourage consumers to opt for healthier product selections through education, and suggests that increased taxation on sugar-sweetened beverages would penalize retailers and encourage a grey-market economy in such products, potentially creating public health risks. The Canadian Beverage Association highlights British Columbia’s recent ranking as the healthiest province in Canada, and gestures toward mounting financial stressors having an impact on the beverage industry. Both industry associations emphasize an education- rather than taxation-based approach to encouraging healthy beverage choices. In its presentation before the Committee in Vancouver, the Canadian Taxpayers Federation recommended against food and drink taxes.

Training for Health Care Professionals

The Committee heard from several associations representing health professionals regarding population health and health care service disparities between urban and rural areas of the province, and about the proven effectiveness of interdisciplinary teams in providing cost-effective, comprehensive health care services for British Columbians.

In Vancouver, the British Columbia Association of Kinesiologists described for Committee Members its important role in primary and community care, supporting diverse needs of groups including our province’s aging population, and working effectively in interdisciplinary teams to support population health and offset acute care costs. During a public hearing presentation in Richmond, the British Columbia Chiropractic Association emphasized an important role for their profession in an interdisciplinary, team-based approach to health care, and recommended increased integration of chiropractic care in a collaborative care model to increase efficiency of service delivery for patients.

Physiotherapists for Northern Communities highlighted a role for physiotherapists in improving health outcomes as part of an interdisciplinary health team, but noted challenges to recruitment and retention in rural and remote areas across the province. Physiotherapists for Northern Communities requested funding for 20 physiotherapy seats, to be placed in the north at UNBC.

Conclusions

Committee Members were pleased to hear perspectives on health care in our province from diverse service providers, health sector and industry advocacy groups, and interested British Columbians. Committee Members are unanimous in their intention to reflect broadly the information collected during the consultation period, during presentations at public hearings and in the support materials provided by presenters, and in written submissions.

The Committee heard about the important work hospices perform in British Columbia, and about increasing demographic-driven demand for end-of-life services for patients and caregivers. In terms of the cost-benefit ratio, presenters pointed out that funding for hospice care and bereavement programming alleviates cost pressures at other points in B.C.’s health care system.

Members learned that B.C.’s school-based human papillomavirus (HPV) vaccination program protects many young people from certain cancers, and heard recommendations to extend the program to encompass all youth in the province.

On mental health and addictions services, presenters observed areas for improvement in terms of the suite of available services and equitable access to such services across the province. With demand for preventative supports and early intervention highlighted, Committee Members felt it important to emphasize particular opportunities to bolster children and youth mental health.

Presenters’ varied comments on the Province’s Medical Services Plan drew Committee Members to conclude that a broad review of the plan would be timely. Similarly, Members felt that differing perspectives on an appropriate government public health response to the potential health concerns associated with sugar-sweetened beverages warrants further investigation.

A variety of professional organizations that represent non-physician health care practitioners, including physiotherapists, kinesiologists, chiropractors and nurse practitioners, presented to the Committee and outlined the benefits of non-medical health care services. In some cases, provision of these services can work proactively to help British Columbians alleviate or lessen ongoing health concerns and prevent more serious impacts on their health and ultimately, on the health care system.

Committee Members heard about limited access to health services in rural and remote areas of the province, and received recommendations for an increased role for integrated, interdisciplinary teams in providing a continuum of health care services across the province — from health promotion and disease prevention, through to acute care. The Committee recognizes an opportunity to improve access to services and to support an interdisciplinary service delivery approach through exploring professional development and training opportunities for health care professionals, and providing incentives for them to practice in rural and remote areas of British Columbia.

Recommendations

The Committee recommends to the Legislative Assembly that the provincial government:

Recommendations |

- Expand support and funding for a broad range of hospice care and bereavement programs to ensure that these services are available to British Columbians and their families. (2013: #46)

- Expand the current Human Papillomavirus (HPV) vaccine school-based program to include equal protection for all boys and young men.

- Conduct a broad review of the Medical Services Plan (MSP) premiums, including threshold levels, comparisons to other jurisdictions, costs of administering the program, and alternatives.

- Improve and expand access to mental health and addictions services, including better coordination of services and dedicated initiatives for early intervention and prevention. (2013: #45)

- Ensure that a coordinated, effective and responsive system is in place for children and youth who face mental health challenges, including early intervention strategies. (2014: #17)

- Explore the implementation of a tax on sugar-sweetened beverages to counteract potential health concerns associated with the consumption of these beverages, including obesity and diabetes, and ensure that any resulting revenues are directed to help support and promote healthy living. (2013: #50 and 2014: #19)

- Review the cost-effectiveness and efficacy of providing coverage of non-physician health services and greater utilization of nurse practitioners.

- Take additional measures to train and recruit health care professionals and develop incentives for them to remain in or locate to rural and remote communities.3(2013: #42 and 2014: #15)

|

|

3 This recommendation also relates to the Advanced Education topic in this report.

Throughout the consultation period numerous propositions were made, from organizations and individuals presenting to the Committee, about the importance of protecting and preserving the environment. Parks management also emerged as a predominant area of focus.

Suggestions for ways of bolstering provincial capabilities to attract additional tourism were made, along with ideas of encouraging the development of new and innovative clean energy initiatives. Submissions that detailed improvements for invasive species management were also heard, with practical policy suggestions presented for consideration.

BC Parks

Almost all of the feedback received with BC Parks as a focus were made in the form of written submissions to the Committee. Almost two thirds of submissions were from organizations, representing geographical regions spread across the province. The Outdoor Recreation Council of BC (ORCBC), who represent the interests of the public outdoor recreation community, working on behalf of around 40 provincial member groups and representing over 100,000 individuals requested a review of the accounting methods used by BC Parks so that the public can more easily understand funding allotments. The ORCBC’s submission suggested that the current funding level of BC Parks’ operating expenses is inadequate, an opinion prominent within the majority of the respondents who commented on this topic.

Over half of the written submissions on parks agreed with the ORCBC, asking for more resources to be put into preserving BC Parks and protected areas, with calls for significantly increased funding to support both parks management and maintenance. Many of these individuals and organizations also placed a spotlight on the need for additional park rangers, highlighting situations where tourism opportunities have been negatively impacted or underutilized, due to the lack of support, care and promotion of British Columbia’s parks.

Clean Energy

There were a wide variety of suggestions received by the Committee to encourage the expansion of energy options, biodiversity preservation initiatives, and provincial environmental conservation programs. The Western Silvicultural Contractors’ Association, an organization dedicated to improving standards in forestry and ecosystem management, called for additional support to develop and improve clean energy initiatives and improve forest ecosystems, such as the BC Bioenergy Network. Altentech Power and associates also requested the re-capitalization of the BC Bioenergy Network, and requested that government ensure that plans are in place to ensure B.C. industries are equipped to react to future demands for clean energy.

Environmental organizations such as the David Suzuki Foundation expressed concern that the climate leadership shown in B.C. requires reinvigoration and suggested this area needs modernizing to achieve legislated goals for greenhouse gas reduction. They were supportive of efforts to strengthen climate action initiatives and asked for an expansion of the carbon neutral capital program funding, to match the original Public Sector Energy Conservation Agreement.

In Surrey, the Committee heard from Innergex, a renewable energy producer, who suggested several clean energy proposals for consideration. One suggestion was for a Strategic Infrastructure Fund to be established to encourage the use of clean and renewable energy, which also received additional support from other clean energy organizations and concerned individuals. Another idea expressed in multiple submissions, including Clean Energy Association of BC’s, was to provide additional support for emerging businesses competing in the growing market for clean energy technologies.

Environmental Protection and Policy

Many individuals wrote to the Committee with their concerns and suggestions centered on the importance of our environmental policies in light of climate change issues and emerging research. Individuals and organizations reiterated the importance of taking a responsible approach to budget development and prioritizing investment, not just for specific environmental issues, but for policies that can have an indirect effect on the environment, such as housing, natural resource and fiscal policy development.

The importance of protecting our food and fresh water production, investing in green technology, minimizing the impacts of climate change and providing better environmental regulation were common themes throughout many submissions received.

Invasive Species and Plants

Numerous organizations from across the province submitted written submissions and presented to the Committee on the importance of preventing and managing invasive species in B.C. There was a consensus within all of these submissions for the government to ensure sufficient funding for reducing the major economic and environmental damage caused by invasive species.

In Kamloops, the Committee heard from the Invasive Species Council of British Columbia (ISCBC) regarding the damaging impact that invasive species are having on the provincial economy. They quoted recent studies that show the negative impact on B.C. fisheries, agriculture and forestry. ISCBC noted that there is an urgent need for an increased understanding and improved operational practices to prevent invasive species entering, becoming established in, and spreading across, the province.

Submissions focused on the need to streamline and enforce government regulations, including a suggestion from the ISCBC to create an Invasive Species Act. They suggested this should be supported by enforcing relevant regulations to ensure better management of B.C.’s Crown land.

The Coastal Invasive Species Committee also suggested that it was timely to update legislation — specifically the Weed Control Act. This registered charity represents diverse stakeholders throughout Vancouver Island, the Gulf Islands and the Sunshine Coast, encompassing nine Regional Districts, 37 Municipalities, 15 Gulf Islands and 57 First Nation Groups. In their presentation to the Committee, they stressed the importance of prohibiting the sale of invasive species and plants for protecting our provincial biodiversity and requested that funding be increased to tackle this escalating problem.

Conclusions

The Committee agreed with the need for increased funding for BC Parks, recognizing the potential for this sector to increase revenue and attract tourism along with its associated longer term socio-economic benefits for the province. Recommendations were made to boost investment for this sector, including the allocation of additional funds to be invested into the management and maintenance of the province’s protected areas. A specific consideration that the Committee endorsed was the need to provide additional park rangers to ensure the responsible stewardship of our provincial parks.

Clean energy initiatives was another key area that the Committee was keen to support. Aligning with the 2014 recommendations on this topic, the Committee requests government seriously contemplate the development and implementation of a clean energy and energy conservation strategy.

Ecosystem and biodiversity restoration programs were another area in which the Committee expressed particular interest.

The Committee recognized the integral part that funding for effective intervention can have on the management of invasive species, adding that consideration be given to updating legislation, where applicable, in order to prohibit the sale of invasive species and plants in B.C.

Recommendations

The Committee recommends to the Legislative Assembly that the provincial government:

Recommendations |

- Increase funding for BC Parks and protected areas management, maintenance and provide more park rangers.

- Provide strategic supports and investment for the further development of clean and renewable energy technologies, low carbon infrastructure and ecosystem and biodiversity restoration.

- Embrace a clean energy and energy conservation strategy and build upon the success of the clean energy sector and programs (e.g. LiveSmart BC and Innovative Clean Energy Fund) to enable B.C. economic development, with prominent participation by First Nations. (2013: #64 and 2014: #54)

- Ensure sufficient funding for the proactive prevention and management of invasive species and noxious weeds and update existing legislation, where applicable, to prohibit the sale of invasive species and plants. (2013: #63 and 2014: #57)

|

|

As in previous years, the Committee received considerable input from a range of organizations and individuals, including non-profit groups, service providers, advocacy groups and community organizations on the topic of social services. This topic is a complex one with many inter-related aspects that affect British Columbians including: poverty reduction for families and individuals, affordable housing, domestic violence, aging populations, the provision of social assistance and support for persons with disabilities.

The Committee heard a number of recommendations to improve social services, provide support for seniors, address homelessness, ensure access to services and supports for those affected by domestic violence, reduce poverty and provide affordable childcare options for families. Presenters highlighted the need for better coordination among service providers and ministry support services to ensure effective and efficient service delivery to ministry clients.

Affordable Childcare

The need for affordable childcare was highlighted by many organizations that presented to the Committee and is something that has gained national interest as families across the province and the country struggle to ensure they have options available to them for childcare while parents are at work. The Coalition of Child Care Advocates of BC presented to the Committee and outlined their recommendation in support of an affordable childcare plan and suggested that the province put childcare at the top of the agenda in discussions with the federal government.