The Legislative Assembly of British Columbia

Legislative Assembly Management Committee Accountability Report, 2014-2015

Legislative Assembly Management Committee

40th Parliament

December 7, 2015

Table of Contents

Message from the Speaker

Composition of the Legislative Assembly Management Committee

Introduction

Context

Progress and Achievements

Strengthening Budget Management

Enhancing Financial Administration

Modernizing Governance

Transparency Initiatives

Ensuring a Secure and Accessible Legislative Assembly

Moving Forward

Departmental Performance Report

Managment Discussion and Analysis

Financial Statements

Appendix A: Legislative Assembly Management Committee Decisions

Appendix B:

Legislative Assembly Management Committee Act

November 2015

To the Honourable Legislative Assembly of the Province of British Columbia

Honourable Members:

I have the honour to present the Legislative Assembly Management Committee’s

Accountability Report 2014-15. This report highlights our actions to strengthen the Assembly’s financial management and administration.

I have the honour to present the Legislative Assembly Management Committee’s

Accountability Report 2014-15. This report highlights our actions to strengthen the Assembly’s financial management and administration.

In the past fiscal year, we managed operating and administrative costs to hold the Assembly’s budget authorization for the 2015-16 fiscal year at the previous year’s level. We initiated the posting of receipts for Members’ expenses on the Assembly’s website, to further our commitment to transparency and accountability.

The Parliament Buildings are where the Legislative Assembly’s 85 Members meet to represent their constituents as they consider new laws and the expenditure of public funds. The Parliament Buildings are also the people’s house, where British Columbians can see their Legislative Assembly work and visit their Members. So, I am particularly proud of the Committee’s work to ensure a secure and accessible Assembly.

We have enhanced security, improved access to the Assembly, and made more information available online to Members and citizens. We increased the Assembly’s outreach to schools, with a renewed Speaker in the Schools program to engage with young people and encourage them to become involved in democracy and making their communities better.

The Committee also supported the construction of a Fallen Paramedics Memorial. We worked with the Ambulance Paramedics of British Columbia and government partners on funding and a design to honour fallen paramedics in British Columbia. This new memorial recognizing these brave women and men was unveiled on the Assembly’s grounds in May 2015, between the existing British Columbia Law Enforcement and Firefighters memorials.

In the next year, we will advance further reforms to financial management and accountability, improve accessibility at the Assembly, and expand the availability of parliamentary information to Members and British Columbians through the use of new technology.

I am grateful to Committee Members and Legislative Assembly staff for their commitment and dedication in achieving a more open and accountable Legislative Assembly.

Respectfully submitted on behalf of the Committee,

Honourable Linda Reid

Speaker of the Legislative Assembly of British Columbia

Composition of the Legislative Assembly Management Committee

Members |

|

Clerk to the Committee

Craig James

Clerk of the Legislative Assembly

This has been a year of progress for the Legislative Assembly’s staff in serving the Assembly and its Members, and in supporting the Legislative Assembly Management Committee’s work to strengthen financial management and administration.

This has been a year of progress for the Legislative Assembly’s staff in serving the Assembly and its Members, and in supporting the Legislative Assembly Management Committee’s work to strengthen financial management and administration.

Our strategic goals were to support the Assembly’s key legislative functions; to deliver effective, responsive and accountable financial management and administration; to ensure that Members and British Columbians are well-informed about the work of their Legislative Assembly; and to provide a secure and accessible environment for all Members, staff, and British Columbians.

Our progress in advancing these goals includes the following initiatives.

-

Supporting the Assembly’s key legislative functions – including the Assembly’s debate and adoption of the February 2015 budget, 19 ministry Estimates, and 37 bills, and 13 parliamentary committees carrying out three statutory officer appointment processes and a record six public consultations.

-

Strengthening budget review – with the first ever independent Legislative Assembly Support Programs Accountability Review, and expanded reporting and analysis on budget management to support effective decision-making by the Legislative Assembly Management Committee.

-

Reforming financial administration and transparency – through strengthened internal controls and administration, implementation of Committee decisions to enhance transparency on Assembly expenditures, Members’ compensation and expenses, and Executive Staff Travel quarterly reports.

-

Ensuring a secure and accessible Legislative Assembly – with updated equipment and training, strategic partnerships with police and intelligence agencies, and enhancements to our business continuity and emergency preparedness plan.

-

Using new technologies to expand access to parliamentary information for Members and British Columbians – by launching a renewal of the Assembly’s website, increasing the use of social media, and modernizing the Legislative Library’s information services.

We will build on these accomplishments in the year ahead as we support the Legislative Assembly Management Committee in enhancing the accountability, efficiency, and effectiveness of the Legislative Assembly’s administration and operations.

Craig James

Clerk of the Legislative Assembly of British Columbia

Good financial management and administration at the Legislative Assembly require effective governance, the use of best practices for administrative rules and procedures, and accountability to British Columbians for the use of taxpayers’ funds.

Good financial management and administration at the Legislative Assembly require effective governance, the use of best practices for administrative rules and procedures, and accountability to British Columbians for the use of taxpayers’ funds.

The governance framework for the Legislative Assembly was established in 1992 through the

Legislative Assembly Management Committee Act. The Act sets up an all-party Legislative Assembly Management Committee (the Committee) which serves as the Assembly's parliamentary management board. It is responsible for: the sound administration of the Assembly’s operations; the provision of effective administrative and financial policies and support for Members in the discharge of their parliamentary and constituency responsibilities; and prudent Assembly budgets and expenditures on behalf of all British Columbians.

The Act also provides for accountability to the Legislative Assembly and British Columbians through the publication of this annual report on the Committee’s work and decisions taken in the past year.

The Committee consists of the following Members of the Legislative Assembly: the Speaker, who serves as Chair; the Government House Leader; the chair of the Government Caucus; a cabinet minister; the Opposition House Leader; and the chair of the Opposition Caucus. Recent practice has been to appoint the Government Whip in place of a minister. The Committee is supported by the Legislative Assembly’s non-partisan staff under the leadership of the Clerk of the Legislative Assembly, with advice, information, and operational services to implement decisions of the Committee.

The Committee has initiated a multi-year program to strengthen financial management, accountability, and transparency in the Legislative Assembly’s use of taxpayers’ funds. This is an ongoing initiative to ensure that the Legislative Assembly is following best practices in governance and financial management.

Guided by principles of openness, transparency, and accountability, the Committee is:

- Improving accountability for the Legislative Assembly’s expenditures.

- Expanding the public disclosure of Members’ compensation and expenses.

- Enhancing the effectiveness of the Assembly’s financial management and administration.

Progress and Achievements |

|

The Legislative Assembly Management Committee made further gains in 2014-15 in advancing the Assembly’s financial management and accountability to British Columbians.

The Legislative Assembly Management Committee made further gains in 2014-15 in advancing the Assembly’s financial management and accountability to British Columbians.

At the top of its achievements, the Committee approved a budget containing total Legislative Assembly spending for the 2015-16 fiscal year at the previous year’s level, by limiting operating and administrative costs. Other accomplishments include posting reimbursable receipts for Members’ travel and constituency expenses on the Assembly’s website, and strengthening analysis and information on the Assembly’s financial management, which is provided in a new Management Discussion and Analysis section on pages 32-38. The Committee also took action to enhance security and accessibility at the Assembly, and to improve the availability of parliamentary information for Members and citizens.

Strengthening Budget Management

The Legislative Assembly Management Committee has reformed its governance and decision-making in order to strengthen management and enhance accountability to British Columbians for the expenditure of public funds. Strengthened budget management is helping the Committee in implementing its commitment to control spending and keep the Assembly’s administrative operations lean.

- Regular public meetings and the publication of meeting decisions and documents have increased openness and strategic direction over the Assembly’s budget and administration.

- The ongoing work of the Finance and Audit Committee, comprised of the Speaker, the government and opposition Caucus Chairs, and the Clerk of the Legislative Assembly, resulted in more systematic oversight of Assembly finances and controls, and a more deliberate approach to ensuring value for taxpayers’ money.

- Continued professional support from an Audit Working Group and regular attendance at Committee and Finance and Audit Committee meetings by external advisors have enhanced the provision of information, analysis, and advice to support Committee Members with decision-making on financial and administrative issues.

The Committee held its first public consideration of the Assembly’s budget in 2013-14. The Committee wrapped up its deliberations by deciding to scale back spending to a “hold the line” budget for the 2014-15 fiscal year.

In 2014-15, the Committee built on its 2013-14 decisions with an independent fundamentals review of Assembly support programs, increased expenditure reporting and management, and continued prudence in budget deliberations.

Independent Review of Support Programs

In May 2014, the Committee supported the initiative of the Clerk of the Legislative Assembly for the first ever independent Legislative Assembly Support Programs Accountability Review. The objectives of the review were: to focus Assembly support programs on priorities which serve the needs of Members; to identify opportunities for efficiencies, cost savings, and ways to improve service delivery; and to ensure the best possible use of taxpayers’ funds.

A robust fundamental review of support programs was carried out by an independent external financial consultant – Arn van Iersel, a former Acting Auditor General and Comptroller General for the province of British Columbia. The review concluded that the Assembly’s support programs compare well to other Canadian jurisdictions in terms of staffing and costs, and that there were opportunities to improve on efficiencies and reduce costs. The review called for initiatives across all Assembly departments to generate savings of over $1 million, with the redirection of some savings to fund higher priorities, including the Committee’s May 2014 decision to hire two new staff to post Members’ expense receipts.

The review also recommended follow-up work to identify further actions to enhance programs and generate added savings, including the use of new technologies and administrative changes to improve service, reduce costs, and ensure value for money in the delivery of services.

Expanding Expenditure Reporting and Management

Governing bodies require good reporting and information on a timely basis to support effective financial management and decision-making.

In 2013, the Committee put in place more systematic reporting and approval procedures to strengthen its management and oversight of the Assembly’s overall budget as well as proposals for the significant expenditure of taxpayers’ funds. In 2014, regular reporting and tightened approval processes were expanded to ensure that significant expenditure initiatives are necessary and within annual budget appropriations.

Based on the recommendation by the Finance and Audit Committee, it was agreed in May 2014 that the Legislative Assembly Management Committee would consider and approve all capital projects less than $25,000, as a group submission, subject to the requirement that should the initial estimate for any project change by 10 percent or more or the scope change significantly, that the project be re-submitted to the Committee for approval. In addition, the Committee decided that its approval will continue to be required for all capital projects greater than $25,000, on an individual basis, subject to the same price and scope change requirements as noted for capital projects less than $25,000.

Supporting Effective Budget Deliberations

The Committee used its expanded expenditure management processes and the recommendations of the Legislative Assembly Support Programs Accountability Review to trim administrative and operating costs, improve program delivery, and redirect savings to higher priorities for the Assembly’s 2015-16 fiscal year budget.

Building on the previous year’s decisions to scale back spending to a “hold the line” budget for the 2014-15 fiscal year, the Committee approved a budget containing total Legislative Assembly Vote 1 spending for the 2015-16 fiscal year at the previous year’s level.

Enhancing Financial Administration

The Legislative Assembly Management Committee is overseeing a comprehensive multi-year program to enhance the financial administration of taxpayers’ funds. More rigorous internal controls are helping to ensure systematic and prudent administration of Assembly expenditures. Strengthened professional advice on financial matters is improving support for the implementation of Committee decisions.

Modernizing Financial Administration and Internal Controls

In May 2014, the Committee resolved that the Finance and Audit Committee perform a systematic review of all key financial policies and controls affecting spending by the Legislative Assembly and Members, for consideration and approval by the Legislative Assembly Management Committee.

The Committee agreed in November 2014 to adopt the first ever independently audited Financial Statements of the Legislative Assembly of British Columbia for the year ended March 31, 2014. The Financial Statements were audited by the Office of the Auditor General, which provided an unqualified opinion, assuring British Columbians that the statements are fair and reliable. The 2013-14 Financial Statements were included in the

Accountability Report, 2013-14. The

2014-15 Financial Statements form part of this

Accountability Report.

In 2014-15, the Committee continued to advance its program of financial reform, including revised financial and operating policies, updated financial and accounting systems, automated financial disclosure, and improved reporting.

- To promote effective and up-to-date financial administration and the use of best public sector practices, the Committee agreed to a Finance and Audit Committee recommendation to establish a two-year internal audit plan for 2014-15 and 2015-16 as well as an Internal Audit Charter. Under the new plan, the Committee will be working with an internal auditor to modernize internal Assembly rules and processes.

- The Committee approved the Assembly’s 2014-15 first and second quarter financial results in November 2014, as part of its expanded financial reporting and oversight processes.

- The Committee decided in May 2014 to eliminate the practice of providing per diems to accompanying persons in the family travel category, in keeping with the Committee’s ongoing work to ensure fair and consistent rules for Members’ travel expenses, and prudent management of taxpayers’ funds.

- The Committee agreed to adopt the recommendation of the Finance and Audit Committee that Members’ travel and constituency office receipts, processed from October to December 2014, be released in February 2015, utilizing a report model approved by the Finance and Audit Committee.

- The Committee adopted the recommendation of the Finance and Audit Committee regarding an up-to-date accounting policy for the Legislative Library collection.

Increasing Professional Support

Sound financial administration requires accurate and timely information and advice from qualified staff with the skills to provide leadership and effectively implement decisions on policies and procedures.

In 2014-15, the Committee continued to strengthen the capacity of the Assembly’s professional staff to support the Committee’s responsibilities and the implementation of its decisions. In May 2014, two new positions were approved in the Financial Services Branch, comprised of one manager and one financial analyst, to implement the Committee’s decision to expand Members’ quarterly public disclosure reports by the proactive disclosure of reimbursable receipts for travel and constituency office expenditures.

Openness and transparency enable public sector entities to demonstrate that they are serving the public interest, supporting the engagement of citizens, and fostering public trust and confidence in decisions and actions.

Proactive Disclosure of Members’ Remuneration and Expenses

The Committee has advanced a transparency agenda through a series of initiatives.

- In May 2013, a new

Members’ Guide to Policy and Resources website was launched to assist new Members and make travel, administrative, and financial policies publicly available for the first time for all Members and British Columbians.

- In October 2013, the Assembly initiated expanded quarterly disclosure of travel expenses, including ministerial and parliamentary committee travel expenses.

- In October 2013, online quarterly disclosure of Members’ remuneration commenced.

- In January 2014, the Assembly proceeded with work for disclosure on the Assembly website of Members’ constituency office expenses, and the disclosure of Members’ constituency office expenses was launched in April 2014.

In May 2014, the Committee initiated work for the posting of receipts for Members’ travel and constituency office expenses on the Assembly’s website. In March 2015, Members’ reimbursable expense receipts for September to December 2014 were posted. The Legislative Assembly is the second parliamentary jurisdiction in Canada, after the Legislative Assembly of Alberta, to post copies of Members’ reimbursable expense receipts.

The Committee also agreed in May 2014 to proactively release materials prepared for the Committee’s public deliberations prior to each meeting, including the minutes of Finance and Audit Committee meetings.

Supporting New and Departing Members after a General Election

B.C.’s

Constitution Act establishes a general election on the second Tuesday in May every four years after May 2005. The next general election will be held on May 9, 2017. The advance provincial general election date facilitates planning to support new and departing Members.

After the May 2013 general election, the Legislative Assembly enhanced orientation, information, and training programs for Members and their staff to support the implementation of the Committee’s transparency initiatives.

- Orientation programs provided in-depth information on the functions of the Assembly and Members, Assembly administrative operations, procedural guidance, and support for Members, and the implementation of transparency initiatives.

- A new

Members’ Guide to Policy and Resources website was inaugurated, providing Members and their staff with a comprehensive one-stop source for policies and reporting on Members’ compensation and expenses.

- The Legislative Assembly retained Shared Services BC to act as a consultant to advise new and returning Members on constituency office lease arrangements.

- The Assembly initiated its first orientation seminar for Members’ Constituency Assistants, with training on financial management, office expenses, proactive disclosure, and reporting requirements. Further ongoing training resources and support from Assembly personnel have assisted Members and their staff with the implementation of expanded disclosure requirements.

In advance of the May 2017 provincial general election, planning and preparations are underway to deliver services and programs for new and departing Members. Consultations with Members and caucus staff will be undertaken to ensure that these services are tailored to the specific needs of Members, including the following initiatives.

- A revised

Members’ Guide to Policy and Resources website, including the Committee’s changes to Assembly policies and guidelines since May 2013, supported by orientation sessions and briefings on procedural, administrative, and personnel issues.

- An updated Transition Guide for Non-Returning Members of the Legislative Assembly, supplemented by briefings to address human resources questions from Members.

- Identification of the accommodation, information technology, and equipment needs of Members after the election, and the development of plans to ensure that these requirements are in place to support the Assembly and Members at the start of the next Parliament.

A secure and accessible working environment enables the Legislative Assembly and Members to carry out their functions of holding government to account, and scrutinizing legislation, taxation, and spending initiatives.

Maintaining a Safe and Secure Environment

To ensure that security and accessibility are a top priority for the Legislative Assembly, the Speaker has set “Health, Safety and Accessibility of the Parliamentary Precinct” as the first business item at Committee meetings, with regular updates on new developments and changes in the security environment.

After the tragic October 2014 attack at the House of Commons in Ottawa, the Committee reviewed the Assembly’s security framework and readiness. The Committee concluded that a principled approach to security and accessibility should be continued, with flexible, seamless, and up-to-date arrangements to effectively manage security risks. The Committee agreed to the implementation of key steps to enhance security and public accessibility at the Parliament Buildings.

-

Up-to-date “Guiding Security Principles” – at the Committee’s direction, the Sergeant-at-Arms consulted with key stakeholders and updated the Legislative Assembly’s “Guiding Security Principles” with procedures which effectively manage security risks, and ensure continued accessibility for Members, staff and British Columbians.

-

Continuation of strategic partnerships with police and intelligence agencies – including information and intelligence sharing and protocols with security partners.

-

Strengthened facilities and screening – including replacement of metal detector equipment for entrances to the Chamber’s Public Gallery; metal detection and X-ray equipment at the Mowat entrance to the main Parliament Building; and a second controlled public access at the main entrance with metal detector and X-ray equipment.

-

Personal safety training programs for Members and staff that work at the Legislative Assembly have been developed.

-

Additional staff with Special Provincial Constable status have been equipped with, and trained on, the use of firearms, and provided with protective vests.

Appropriate and cost-effective facilities support the proceedings of the Legislative Assembly and its parliamentary committees, and enable Members to carry out their parliamentary and consituency responsibilities.

In 2014-15, the Committee reviewed accommodation challenges facing the Assembly – including an increase in the number of Members from 85 to 87 in the May 2017 general election, and the changing space needs of the Assembly and Members – and concluded that planning to meet Assembly space requirements should be an ongoing priority.

The development of space planning proposals should reflect the following principles.

-

Space planning should serve the core activities of the Assembly and Members – with the Chamber, parliamentary committee meeting rooms, and office accommodation for Cabinet Ministers and Members centrally located within the main Parliament Building, and additional workspaces for caucus staff and Assembly departments located in the main Parliament Building or nearby.

-

Space planning should be cost effective – to optimize existing space resources and support best value for long-term investments, maximizing value for money should be a goal of all space planning decisions.

-

Space planning should ensure safety and accessibility – safe, secure, and accessible work and public environments are required to enable the Assembly and Members to carry out their responsibilities on behalf of British Columbians.

-

Space planning should be based on long-term stewardship and vision – prudent stewardship should address increases in Assembly building occupants, including Members and caucus staff; changes to parliamentary business; the evolving roles and responsibilities of Members; the integration of new technology; and the need for a functional work environment that benefits users for years to come.

-

Space planning should respect the Assembly’s architectural history – repairs, renovations, and alterations should uphold the architecture and dignity of the Assembly.

Additional work based on these principles will identify long-term space requirements, and ensure that facilities continue to provide an up-to-date, safe and suitable work environment.

Improving Accessibility to the Legislative Assembly

The Assembly has acted to ensure accessibility to the Parliament Buildings for Members and British Columbians, through barrier-free entrances, automatic doors, access to washrooms, elevator modernization, accessible parking and sidewalks. In 2014-15, work continued on accessibility initiatives throughout the Assembly’s facilities.

- Eight doors throughout the Parliament Buildings were upgraded with automatic door openers to improve accessibility.

- Three washrooms were retrofitted to provide barrier-free access, and automatic door openers were installed at public washrooms near the Legislative Dining Room.

- An Evacutrac Chair was purchased to facilitate safe emergency evacuation of Members, staff, and visitors.

Outreach to British Columbians on the work of the Assembly, its Members, and its parliamentary committees was also improved, with a special focus on schools, students, and teachers. In 2013, a renewed Speaker in the Schools program was launched to encourage students in grades 4 through 7 to engage in democratic activities, with a model legislature exercise and a simulation of the stages of how a bill becomes law on topics chosen by students. Following visits to schools in Haida Gwaii in 2013, the Speaker met with 195 students in five schools in the Cariboo area in June 2014 in support of the Speaker in the Schools initiative.

Increasing the Availability of Parliamentary Information

In 2014-15, the Legislative Assembly increased the availability of parliamentary information, by using technology to support cost-effective initiatives such as digitizing information, and using social media to engage stakeholders and gather evidence for parliamentary committee inquiries.

- A project to modernize the Assembly’s website was launched, with improved design and functionality to support Members and British Columbians with expanded online availability of parliamentary information.

- The Assembly’s parliamentary committees used online processes and social media to support a record six public consultations, on the annual provincial budget, sustainable health care, child and youth mental health, oversight of police services, information access and privacy, and local elections expense limits.

- Following up on the Committee’s March 2014 agreement to consider the role and mandate of the Legislative Library, the Clerk of the Legislative Assembly launched a strategic review of the Library’s role in meeting the evolving needs of Members. The review identified ways to strengthen information services to Members and refocus on expanded digital services and access for Library clients.

Supporting a Fallen Paramedics Memorial

The Parliamentary Precinct constitutes a symbolically important gathering place in the province. The grounds of the Parliament Buildings are the site for a range of memorials which honour the contributions British Columbians have made to the protection of our province and its citizens.

Partnerships with governments and stakeholders ensure that the rehabilitation and construction of new memorials reflect the values and interests of all British Columbians. The Committee was advised in December 2014 that a federal government grant had been secured for the rehabilitation of the Cenotaph War Memorial.

At the Committee’s November 5, 2014 meeting, the Speaker provided information on a new Fallen Paramedics Memorial, and the activities of the Finance and Audit Committee in advancing this project. Work was undertaken with the Ambulance Paramedics of British Columbia and government partners on funding and a design to honour fallen paramedics. The new memorial was unveiled in May 2015, between the existing British Columbia Law Enforcement and Firefighters memorials at a special ceremony involving the Speaker, the Ambulance Paramedics of British Columbia, Hon. Terry Lake, Minister of Health, and Leader of the Official Opposition, John Horgan.

Enhancing Business Continuity and Emergency Preparedness

An independent review of business continuity in 2013 concluded that the Legislative Assembly is well prepared to respond to emergencies, and that planning should continue to strengthen preparedness.

In 2014-15, the Assembly worked with Emergency Management BC on the enhancement and testing of business continuity and emergency preparedness. Two business continuity plan test exercises were undertaken to ensure a strong level of readiness, and to identify additional areas for follow-up. Work is advancing on a robust business continuity, emergency preparedness and disaster recovery plan which is consistent with government business continuity plans. A comprehensive business continuity plan is being designed to maintain critical operations following a disruptive incident or crisis, including but not limited to an earthquake, fire, flood, or terrorism.

Over the past year, the Legislative Assembly Management Committee’s achievements have strengthened the Assembly’s financial management, improved the effectiveness of administrative operations, and enhanced accountability and transparency for the use of taxpayers’ funds.

Building on these achievements, the Committee will focus on the following priorities in the year ahead.

-

Advancing the Legislative Assembly’s multi-year program to strengthen financial management, accountability, and transparency– with support from the internal audit program and financial governance enhancements, including an updated financial/accounting system, revised financial and operating policies, an automated system for financial disclosure, and improved reporting.

-

Harnessing technology to increase the availability of parliamentary information and information services to Members and all British Columbians – with website innovations, improved document management systems, and more up-to-date, timely, and cost-effective Library information services.

-

Ensuring safe and suitable facilities for the work of the Legislative Assembly and Members – to address increases in the number of Members, and evolving requirements for accommodation and technology to support the responsibilities of the Assembly and its Members.

-

Implementing a robust Business Continuity, Earthquake Preparedness, and Disaster Recovery program – including collaboration with government to ensure the continued operation of governance institutions.

-

Planning for the completion of arrangements for the dissolution of the 40th Parliament and for the next general election in May 2017 – with support for the induction of new Members, orientation and administrative programs for Members and their staff, and procedural advice and operational services for the launch of the new Parliament.

We will also work with government and other partners in planning celebrations of historic events, including the 150th anniversary of the Confederation of Canada in 2017, and the 150th anniversary of British Columbia’s entry into Confederation in 2021.

As we prepare to mark these important milestones in the life of our country and our province, we will ensure that we have the best governance, procedural, and administrative framework for advancing parliamentary democracy to serve the future needs of British Columbians.

Departmental Performance Report |

|

This section of the

Acountability Report highlights the work of the Legislative Assembly’s administrative departments in: supporting the Assembly’s key functions to legislate, authorize expenditures and taxes, and undertake legislative oversight; delivering effective, responsible and accountable financial management and administration; ensuring that Members and British Columbians are well-informed about the work of their Legislative Assembly; and providing a safe and secure environment for Members, staff and citizens.

Performance indicators and measures are used by parliamentary jurisdictions and governments to evaluate their success in meeting goals. A range of performance indicators and measures is provided at the end of this section, and will be developed further in the next

Accountability Report.

Goal 1 |

The Legislative Assembly’s key functions to legislate, authorize expenditures and taxes, and undertake legislative oversight are supported. |

Two primary roles of the Legislative Assembly are to make laws and authorize the expenditure of public funds in British Columbia. In doing so, opportunities exist for Members of the Legislative Assembly to examine legislative, expenditure, and taxation initiatives before they become law, and to inquire into government’s policies, programs, and spending plans.

The Clerk of the Legislative Assembly is the principal procedural and administrative officer of the Assembly. As the Assembly’s Chief Executive Officer, the position is responsible for the proper management of facilities, services, and non-partisan Assembly staff. The Clerk is the principal procedural advisor to all Members, assisted by the Deputy Clerk and Clerk of Committees.

Strategic Objectives

- That the Legislative Assembly, its parliamentary committees, and its Members are supported with advice and services which are timely, effective, and aligned with the priorities of the Assembly and its Members.

- That by 2017-18 the Legislative Assembly will have successfully launched the opening of the 41st Parliament after the May 2017 general election, and implemented Members’ orientation programs and administrative services to enable Members to effectively assume their parliamentary and constituency responsibilities in the new Parliament.

- That the Legislative Assembly’s finances and administration are governed by sound and transparent management.

Office of the Clerk

Pursuant to the provincial

Constitution Act, the Clerk is the senior permanent officer of the Legislative Assembly, and is the principal procedural advisor to the Speaker and all Members. The Clerk directs Assembly management and staff in providing non-partisan advice and services to the Assembly and Members.

Pursuant to the provincial

Constitution Act, the Clerk is the senior permanent officer of the Legislative Assembly, and is the principal procedural advisor to the Speaker and all Members. The Clerk directs Assembly management and staff in providing non-partisan advice and services to the Assembly and Members.

The Office of the Clerk produces House documents such as the

Journals,

Orders of the Day and

Votes and Proceedings, and is the repository for tabled documents and petitions. The Clerk is the custodian of all Bills, and certifies the Bills as having been duly passed in the House and transmits official copies to the appropriate authorities including the Lieutenant Governor. The Office provides exemplary, non-partisan procedural advice, and effectively, efficiently, and economically administers all Assembly functions in line with the best leading practices with the aim of being a jurisdictional leader in management, accountability, and procedural innovation.

Key activities in 2014-15 include:

-

Supporting a successful transition to the 40th Parliament, the Assembly’s election of a new Speaker, and the opening of the Parliament’s first and second sessions – through the establishment of regular meetings with the Speaker to ensure effective direction and communication on Assembly issues, the launch of the proceedings of the new Parliament, and orientation programs to support Members in assuming their responsibilities on behalf of British Columbians;

-

Guiding the successful implementation of Legislative Assembly Management Committee decisions – with regular meetings of the Audit Working Group to provide systematic support to the Committee and the Finance and Audit Committee, address financial and management issues, scrutinize policies and potential decisions, and ensure effective implementation of their decisions; and,

-

Leading Legislative Assembly departments and reporting structures for better economy and oversight – by more strategically-aligned resources, and regular Senior Management Team meetings to integrate advice and support for Assembly deliberations, financial management and administration.

Parliamentary Committees Office

Led by the Deputy Clerk and Clerk of Committees, the Parliamentary Committees Office supports the Clerk in providing procedural, operational, communications, and research services to the Speaker and Members to support the deliberative processes and general operations of the Assembly. The Office also provides procedural, administrative, and research support to the Assembly’s parliamentary committees and their Members.

Led by the Deputy Clerk and Clerk of Committees, the Parliamentary Committees Office supports the Clerk in providing procedural, operational, communications, and research services to the Speaker and Members to support the deliberative processes and general operations of the Assembly. The Office also provides procedural, administrative, and research support to the Assembly’s parliamentary committees and their Members.

Key activities in 2014-15 include:

-

Ensuring that parliamentary committee mandates are completed within timelines established by the Legislative Assembly or by statute – through high quality and timely procedural, research, communications, and administrative services.

-

Providing advice and operational assistance to support and implement priorities and policies of the Speaker and the Legislative Assembly Management Committee – including integrated management, communications, and research services for the Committee, the Finance and Audit Committee, and the Audit Working Group.

Goal 2 |

Effective, responsive and accountable financial management and administration. |

The Legislative Assembly is undertaking a comprehensive reform of its financial and administrative procedures to provide the best use of taxpayers’ funds, and to ensure that the Legislative Assembly is following best practices in financial management and administration.

Strategic Objectives

- That by 2017-18 the Legislative Assembly has completed its financial reform initiative, including an updated financial/accounting system, revised financial and operating policies, an automated system for financial disclosure, and integrated constituency office expenses for improved reporting.

- That by 2017-18 the Legislative Assembly and its support functions have moved primarily to electronic documents and processes for business, with electronic approvals, e-forms, electronic document preparation, distribution, and review, a commensurate reduction in printing costs, and continued integrity of parliamentary processes and information.

Financial Services Branch

The Financial Services Branch supports the Legislative Assembly through the provision of advice and services on budgets, financial management and planning, accounting, reporting, public disclosure of Members’ compensation and expenses, and administrative procedures.

Key activities in 2014-15 include:

|

-

Carrying out the Legislative Assembly Management Committee’s decisions on reforms to financial administration – by implementing new control procedures across the Assembly, supporting the work of the Assembly’s internal auditor, improving the efficiency and reporting of the constituency office allowance payment process, and executing decisions on public reporting of Assembly finances and Members’ compensation and expenses, including redacted receipts.

-

Continually improving financial accountability through preparation of the Legislative Assembly’s first Management Discussion and Analysis – this new report provides further insights and explanation of the Legislative Assembly’s financial results, contained in its second set of audited annual financial statements, from management’s perspective.

-

Providing comprehensive support and information to the Legislative Assembly Management Committee and the Finance and Audit Committee – with a documented process for consideration of budget priorities and spending, systematic financial information, and advice on the implications of potential decisions on financial policies.

Human Resource Operations

Human Resource Operations supports the Legislative Assembly through the provision of comprehensive and timely personnel services across all Assembly departments. This work is consistent with practices in other legislative jurisdictions, and includes staffing, position classification, organizational design, employee relations, conflict resolution, learning and development, employee wellness, and general human resources consultative services. The office also provides ad hoc human resources services and advice to Members and constituency offices.

Key activities in 2014-15 include:

-

Continuing to align the delivery of human resources services with leading public sector practices – by providing fair, transparent and consistent personnel policies, guidelines and practices, and sound organizational structures and position classifications.

-

Strengthening human resources management and information systems – with enhanced data collection and report writing to support better strategic planning.

-

Enhancing recruitment and retention – through expanded advertising of positions using the B.C. Public Service Agency’s job opportunities website, other parliamentary jurisdictions, and public sector organizations; training programs and talent management to attract and retain a strong and capable Assembly team; and supporting a new Legislative Lights program led by the Deputy Clerk and Clerk of Committees to recognize achievements, leadership and long service by Assembly staff.

Goal 3 |

Members and British Columbians are well-informed about the work of their Legislative Assembly. |

The work and decisions of the Legislative Assembly and its Members affect the lives of all British Columbians. The Assembly’s departments provide information services to help Members meet their parliamentary responsibilities and to provide British Columbians with information on the work of the Assembly, its Members, and its parliamentary committees.

Strategic Objectives

- That by 2016-17 the public outreach of the Legislative Assembly be improved through expanded televising of Legislative Assembly proceedings including parliamentary committees, innovative web based educational and consultation e-portals on the Assembly’s new website, and enhanced electronic public access to Assembly documents, reports, and proceedings.

Hansard Services

Hansard Services supports the work of the Legislative Assembly by publishing the official reports of House and parliamentary committee proceedings and by producing live broadcasts and webcasts of those proceedings. The branch is committed to ensuring that the work of Members is readily accessible to the public by distributing the broadcasts to the widest possible viewership and by quickly publishing the transcripts on line.

Key activities in 2014-15 include:

-

Improved operational efficiencies – through upgrades to facilitate automated rebroadcasts of Assembly and parliamentary committee proceedings, investments in webstreaming infrastructure to permit greater flexibility in contracting with content distributors; improvements to transcript production hardware and software, eliminating printed indexes, and streamlining the transcript publishing process.

-

Enhancing access to Legislative Assembly information services – by modifying portable recording equipment to ensure reliable webstreaming of parliamentary committee audio from even the most remote communities in the province, and developing the technical specifications to improve the delivery of parliamentary information services through the in-house cable television system.

Legislative Library

The Legislative Library provides research support and library collection services to Members, their staff, and Assembly departments. It does this by providing the information Members need by answering questions; by acquiring books, e-books, reports, and other material; and by other information services.

The Legislative Library provides research support and library collection services to Members, their staff, and Assembly departments. It does this by providing the information Members need by answering questions; by acquiring books, e-books, reports, and other material; and by other information services.

Key activities in 2014-15 include:

-

Strategic planning – in order to better plan for delivering excellent service in changing times for libraries, the Deputy Clerk and Clerk of Committees worked with the Legislative Library to undertake a strategic planning process, which was being finalized at the end of 2014-15 for subsequent presentation and approval to the Legislative Assembly Management Committee.

-

Digitization – the Library continued to partner with provincial entities to make historical B.C. government publications available on line, supplying copies of the 1887-1911 sessional papers to the University of British Columbia, and of the 1863-1871 B.C. Gazette to the University of Victoria, so that digital copies could be made available to the public, in addition to the Library’s ongoing digitization program of early B.C. government publications.

-

Electoral history of B.C. – the Library partnered with Elections BC to issue a supplement to the

Electoral History of British Columbia covering the years 2002-2013, which is available on the Library and Elections BC websites.

-

B.C. trade publications – the Library increased its collection of publications from B.C. organizations, such as associations, councils, non-profit organizations, think tanks, universities, police departments, and colleges, with 342 publications collected from 206 different local B.C. organizations.

Parliamentary Education Office

The Parliamentary Education Office provides programs, print and on-line information on the Assembly’s parliamentary roles and activities to Members and British Columbians. These services support Members with their representational responsibilities at the Assembly and in constituency offices, and enhance public awareness and understanding of the work of the Assembly and Members.

Key activities in 2014-15 include:

-

Enhancing public awareness of the roles and responsibilities of the Assembly and Members – through cost-effective, innovative programs and easily accessible on-line information materials for citizens and visitors.

-

Facilitating student understanding of the work of the Assembly and Members – with student information for distribution by Members and intern programs.

-

Encouraging school and teacher engagement – by the B.C. Teachers’ Institute on Parliamentary Democracy, and a renewed Speaker in the Schools program.

-

Strengthening financial administration and enhancing inventory management – by developing best practices, implementing a new business model, and adopting generally accepted accounting principles for the operation of the Parliamentary Gift Shop.

Information Technology Branch

The Information Technology Branch provides reliable and secure information technology and support services to Members, their offices, and Assembly staff, and ensures accessible online Assembly information for citizens. The Branch uses flexible technologies to ensure that services are cost-effective, efficient and responsive to the changing needs of Members and citizens.

Key activities in 2014-15 include:

-

Ensuring secure, efficient and cost-effective information networks – by developing infrastructure systems which are adaptable to new technologies, responsive to the evolving requirements of Assembly and Members, and positioned to support business continuity and emergency preparedness.

-

Supporting Assembly website services for Members and the public – including enhanced information on Assembly and parliamentary committee activities, regular updates to the

Members’ Guide to Policy and Resources website, and increased on line information on Members’ compensation and expenses.

-

Using technology to increase Members’ access to parliamentary information – by enabling Members of parliamentary committees to access House and committee documents electronically through iPads and the introduction of SharePoint technology for Members review and approval of disclosure reporting.

-

Planning the renewal of the Legislative Assembly’s website – through consultations with key stakeholders, and the development of a plan to improve website design, usability, and accessibility. The new website was launched in October 2015.

Parliamentary Committees Office

In addition to providing procedural, operational, and research services as previously mentioned, the Parliamentary Committees Office ensures that Members and British Columbians have access to timely and high‐quality information on committee activities.

Key activities in 2014-15 include:

-

Enhancing public engagement and consultation mechanisms for use by parliamentary committees – with targeted travel, tele/videoconferencing, and on line public and stakeholder submission processes to support parliamentary committees in carrying out a record six concurrent public consultations, three statutory officer appointment processes, two statutory review processes, and 16 separate areas of inquiry.

-

Improving access to parliamentary committee information – by increasing the on line availability of committee documents, proceedings, and public submissions, and ensuring that Members and the public have timely access to committee decisions and reports.

-

Augmenting the use of social media to enhance public access to information on parliamentary committee activities – by expanded use of social media such as Facebook and Twitter to promote parliamentary committee activities, and to communicate and engage more efficiently with the public and stakeholders.

Goal 4 |

A safe and secure environment for Members, staff and citizens. |

The Legislative Assembly’s security and facilities policies and operations ensure a safe and secure environment for Assembly deliberations, the work of Members and Assembly staff. The Sergeant-at-Arms is responsible for maintaining reliability and protection, and managing the provision of building facility services for the work of the Assembly, Members, and staff.

Strategic Objectives

- That Members, their parliamentary and constituency office staff, and Assembly staff are afforded a secure and accessible environment in which to conduct their business.

- That by 2016-17 a robust Business Continuity, Earthquake Preparedness, and Disaster Recovery program is implemented.

- That by 2016-17 a detailed space inventory of the Legislative Assembly is undertaken, including the upcoming space needs of the Assembly and its Members, as an initial step toward the development by 2017-18 of a comprehensive multi-year Parliament Buildings renewal plan.

Legislative Assembly Protective Services

The Legislative Assembly Protective Services branch provides a safe and accessible environment for Members, staff, and British Columbians. This enables the Assembly, parliamentary committees, and Members to effectively conduct business without interference or interruption, and ensures that the Parliament Buildings are a secure workplace and visitor destination.

Key activities in 2014-15 include:

-

Strengthening strategic partnerships with security partners – including information and intelligence sharing with police partners, and protocols for effective security arrangements in a parliamentary

context. -

Enhanced security equipment, training, and procedures – with the development of improved screening, training, constituency office support services, and up-to-date procedures to maintain safety and security for Members, staff, and visitors in the Parliament Buildings.

Legislative Facility Services

The Legislative Facilities Services branch ensures timely and cost-effective maintenance and building services to support the effective work of the Assembly, its parliamentary committees, and Members.

Key activities in 2014-15 include:

-

Identifying future building space requirements and cost-effective options to meet the changing needs of the Assembly and Members – by developing a detailed inventory of building space needs to support the increase in Members and the changing space requirements of Assembly clients.

-

Improving the efficiency and effectiveness of facilities services – by in-house support for ongoing service requirements and contract arrangements for additional and peak needs.

Legislative Assembly Performance Indicators and Measures

Indicator |

2012/13 Actual |

2013/14** Actual |

2014/15 Actual |

Number of Legislative Assembly sitting days (fiscal year) | 44 | 41 | 70 |

Number of sitting hours (Legislative Chamber and for concurrent Estimates debate in committee rooms) | 416 | 383 | 600 |

Number of active parliamentary committees | 14 | 10 | 13 |

Number of active parliamentary committees meeting hours | 258 | 153 | 243 |

The number of visitors to the Parliament Buildings |

* |

* | 273,319 |

Number of visitors who participated in a Legislative Assembly tour of the Parliament Buildings | 90,249 | 86,701 | 87,080 |

*

Not available for past years – information will be collected for presentation in future years. **

Provincial general election held May 14, 2013 |

Goal 1 – The Legislative Assembly’s key functions to legislate, authorize expenditures and taxes, and undertake legislative oversight are supported.

Intermediate outcomes:

- The Legislative Assembly is able to conduct its business (budget, legislative, and oversight functions) effectively.

- Parliamentary documents, including committee reports, are accurate and publicly distributed in a timely manner.

Performance measures/indicators:

Measure/Indicator |

2012/13 Actual |

2013/14** Actual |

2014/15 Actual |

Number of bills processed accurately through all stages (number of government, members’, and private bills adopted annually) | 45 | 8 | 37 |

Number of parliamentary documents (Orders of the Day,

Votes and Proceedings, Hansard transcripts, and parliamentary committee reports) accurately prepared for distribution | 3789 | 316 | 527 |

**

Provincial general election held May 14, 2013 |

Goal 2 –Effective, responsive and accountable financial management and administration.

Intermediate outcomes:

- The annual financial statements of the Legislative Assembly present fairly, in all material respects, the Assembly’s financial position, and the result of its operations.

- Members and staff are provided with timely and accurate payments consistent with approved Legislative Assembly policies.

- The public receives timely and accurate disclosure reports for Members’ travel and constituency office expenses.

- The Legislative Assembly demonstrates responsible management practices by staying within the approved budget appropriation.

Performance measures/indicators:

Measure/Indicator |

2012/13 Actual |

2013/14Actual |

2014/15 Actual |

2015/16 Target |

The external auditor has provided an unreserved (unmodified) opinion on the financial statements (Yes or No) |

* | Yes | Yes | Yes |

| Percentage of expense disclosure (Members’ travel and constituency office expenses, parliamentary committee travel, and executive travel) released within three months of the close of the quarterly reporting period |

* |

* | 100% | 100% |

The Legislative Assembly has maintained expenditures within its annual budget appropriation (Yes or No) | Yes | Yes | Yes | Yes |

*

Not available for past years – information will be collected for presentation in future years. |

Goal 3 –

Members and British Columbians are well-informed about the work of their Legislative Assembly.

Intermediate outcomes:

- Members and British Columbians receive sufficient and appropriate information to be well informed about the work of the assembly and its parliamentary committees.

- There is appropriate access to the work of the Legislative Assembly, including the parliamentary and committee proceedings.

Performance measures/indicators:

Measure/Indicator |

2012/13 Actual |

2013/14** Actual |

2014/15 Actual |

Total number of Legislative Assembly web pages |

* |

* | 195,000 |

Total number of web pages viewed |

* |

* | 7,412,344 |

| Total number of visits to the website |

* |

* | 1,769,106 |

| The annual number of broadcast hours for parliamentary proceedings (audio and video) | 643 | 536 | 789 |

| Number of British Columbians participating in parliamentary committee consultations (number of presentations, submissions, and applications) | 1,744 | 757 | 3,435 |

| Number of Library information requests received | 3,183 | 3,562 | 3,978 |

| Number of participants in parliamentary education workshops | 349 | 365 | 400 |

Number of students participating in the Speaker in the Schools program |

* |

* | 395 |

*

Not available for past years – information will be collected for presentation in future years. **

Provincial general election held May 14, 2013 |

Goal 4 –A safe and secure environment for Members, staff and citizens.

Intermediate outcomes:

- Members, staff, and visitors are able to conduct their business at the Legislative Assembly and constituency offices without disruption in a safe and secure environment.

- The Legislative Assembly is well prepared for a significant business interruption – e.g., systems failure, terror threat, or earthquake.

Performance measures/indicators:

Measure/Indicator |

2012/13 Actual |

2013/14 Actual |

2014/15 Actual |

2015/16 Target |

The precinct security plan is up to date and was tested in the year (Yes or No) |

* |

* | Yes | Yes |

Number of business continuity plan test exercises |

* |

* | Two | Two |

*

Not available for past years – information will be collected for presentation in future years. |

Management Discussion and Analysis |

|

For the year ended March 31, 2015

The Management Discussion and Analysis (MD&A) reflects the continued commitment of the Legislative Assembly of British Columbia (the Legislative Assembly) to enhanced accountability and transparency. It complements the Financial Statements by providing further analysis and forward looking information on the financial position and results of operations of the Legislative Assembly.

The MD&A should be read in conjunction with the Legislative Assembly’s audited Financial Statements for the year ended March 31, 2015. The financial information in this report has been prepared in accordance with Canadian public sector accounting standards (PSAS), all totals and percentages have been rounded, and all year references are for the year ended March 31.

Financial Results

The Legislative Assembly’s net cost of operations for 2015 was $62.5 million ($66.1 million in 2014) which was $7.1 million ($9.4 million in 2014) lower than the budget of $69.6 million ($75.5 million in 2014). Of the $3.4 million capital budget (same in 2014), the Legislative Assembly incurred $990 thousand in expenditures ($1.9 million in 2014).

In 2015, the Legislative Assembly reported a deficit position of $277 thousand (surplus of $858 thousand in 2014). These results should not be interpreted as positive or negative. As explained in note 15 to the Financial Statements, these results represent a timing difference between the recognition of revenue and expense related to non-financial assets (Tangible Capital Assets, prepaid expenses, and inventories held for use).

Operating Expenses by Function

Total 2015 expenses were $63.1 million, a decrease of $4.3 million from 2014 ($67.4 million), and $7 million less than budgeted. The May 2013 election fell within fiscal 2014 and resulted in additional expenses such as transitional assistance payments to former Members, constituency office equipment refresh costs, and moving and renovation costs. As a result, Members’ Services and Legislative Operations expenses were higher in 2014 by $3.5 million and $861 thousand respectively.

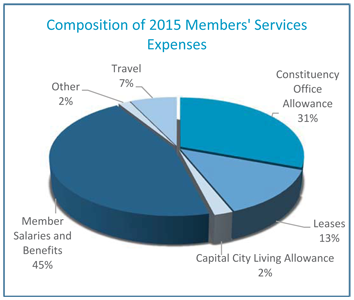

Members’ Services consists of all expenses relating to Members and their constituency offices. The largest component is Members’ salaries and benefits at 45%, followed by the constituency office allowance of $119,000 annually per office.

Members’ Services consists of all expenses relating to Members and their constituency offices. The largest component is Members’ salaries and benefits at 45%, followed by the constituency office allowance of $119,000 annually per office.

Members’ Services expenses were budgeted to be $36.1 million. Actual expenses were $32.7 million in 2015, a decrease of $3.5 million from 2014 ($36.2 million) and $3.4 million from budget, mainly due to election-related transitional assistance of $3.6 million paid to former Members in 2014.

The Government Caucus and the Opposition Caucus, along with Independent Members, receive an annual formula-driven budget to fund their legislative offices (Caucus Support Services). The formula is based on the number of Members within each caucus. As a result, there are minimal variances in annual expenses and budgets within each Parliament.

Legislative Operations was $1.9 million under budget in 2014-15 as a result of savings identified through the independent Legislative Assembly Support Programs Accountability Review (LASPAR), unfilled staff positions, and a decrease in amortization resulting from a reassessment of the Legislative Assembly’s capital asset balances which occurred in 2014.

Variances compared to the budget and 2014 were insignificant for all other departments.

Operating Expenses by Category

The Legislative Assembly’s most significant expense category is Salaries and Benefits, accounting for more than 57% of the Legislative Assembly’s total expenses, followed by Members’ Allowances and Expenses at over 27%. When expenses are sorted by category, the Salaries and Benefits category contains Members’ salaries and benefits.

Salaries and Benefits increased by $0.7 million over 2014 and was $3.3 million under budget as a result of unfilled positions, efficiencies resulting from the LASPAR, and lower than expected benefit costs. Members’ Allowances and Expenses decreased by $3.5 million in 2015 compared to 2014 due to the absence of election–related expenses.

Operating Expenses is comprised of office administration, utilities, telecommunications, and travel. These expenses were $2.1 million under budget and $1.8 million lower than 2014 due to savings found through the LASPAR, lower than expected repairs and maintenance to Legislative Assembly buildings and equipment, and the fact that there was an election during the 2014 fiscal year.

Capital Expenditures by Category

Capital spending varies in amount and by category annually depending on need.

The Legislative Assembly’s capital assets include the Parliament Buildings and surrounding structures, building improvements, desks, computers, servers, maintenance equipment, and specialized broadcasting equipment. Significant fiscal 2015 capital purchases included security upgrades, server equipment and software, and Hansard recording and broadcasting equipment.

When compared to 2014, capital spending was lower in 2015 by $0.9 million. The decrease in spending was largely due to the deferral of some facilities projects.

Revenues

The Legislative Assembly generates revenue from the public and Members through its Dining Room and Parliamentary Gift Shop operations. Combined revenue of over $490 thousand was generated by these operations in 2015 ($485 thousand in 2014). A small amount of revenue is also earned by leasing space on the Parliamentary Precinct to the media and government agencies.

Financial Position

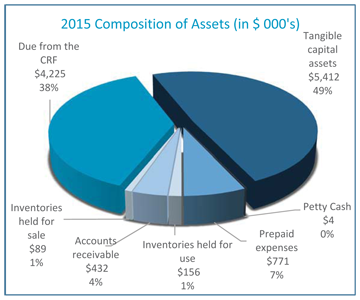

Assets

The Legislative Assembly’s most significant asset balance is Tangible Capital Assets. Capital spending was lower than the amortization amount in 2015, resulting in a net decrease of $212 thousand to Tangible Capital Assets. This was due in large part to budgeted projects being deferred until future years.

The Due from the Consolidated Revenue Fund (CRF) balance is equal to the sum of the Legislative Assembly’s liabilities, less its financial assets. It represents the net amount owed to the Legislative Assembly for expenses incurred for which Vote 1 appropriation funds had not yet been received. This balance fluctuates annually based on the changes in liabilities and financial assets.

The Legislative Assembly bank account is replenished by the Ministry of Finance throughout the year as payments are made; therefore, it maintains a zero balance. The remainder of the Legislative Assembly’s assets are relatively insignificant and did not change significantly in 2015 from 2014.

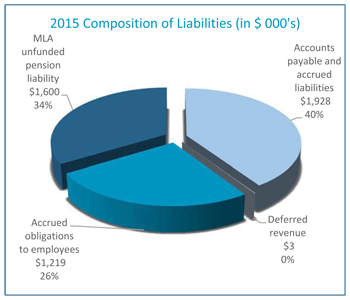

Liabilities

The Accounts Payable and Accrued Liabilities balance was consistent between 2014 and 2015.

Accrued Obligations to Employees is composed of the employee retirement allowance, and the employee leave liability (vacation, etc.). The retirement allowance accrual increased by $91 thousand mainly due to a net increase in the number of employees eligible for the allowance. The employee leave liability increased by $80 thousand as a result of employees carrying forward higher leave balances in 2015 than in 2014.

The present value of the Legislative Assembly’s obligation to the MLA superannuation account decreased, resulting in a $100 thousand reduction in the MLA Unfunded Pension Liability. The balance of the Transitional Assistance liability resulting from the May 2013 election was paid to former MLAs during 2015, resulting in a zero balance at the end of the year. The deferred revenue balance is negligible, and represents deposits for Dining Room events.

Looking Ahead

The tables below summarize actual results for the last two years, the Legislative Assembly’s 2016 budget, and projected results for 2016 to 2018. The 2016 budget and 2016 to 2018 projections reflect the Legislative Assembly’s planned actions based on assumptions and estimates; actual results may vary significantly from the information presented.

Projected Net Cost of Operations

|

Actual |

Budget |

Forecast |

Projected |

(in thousands of dollars) |

2014 |

2015 |

2016 |

2017 |

2018 |

Expenses | | | | | | |

Members’ Services | 36,243 | 32,654 | 36,279 | 33,626 | 36,075 | 44,544 |

Caucus Support Services | 6,846 | 6,933 | 7,211 | 7,039 | 7,196 | 7,258 |

Office of the Speaker | 297 | 329 | 418 | 375 | 382 | 385 |

Clerk of the House | 984 | 900 | 1,017 | 1,017 | 896 | 902 |

Clerk of Committees | 581 | 592 | 628 | 628 | 635 | 639 |

Legislative Operations | 12,939 | 12,078 | 13,694 | 12,314 | 14,058 | 14,630 |

Sergeant-at-Arms | 4,363 | 4,436 | 4,862 | 4,848 | 5,026 | 5,080 |

Hansard Services | 3,360 | 3,572 | 3,818 | 3,677 | 3,818 | 3,855 |

Legislative Library | 1,796 | 1,578 | 2,171 | 2,000 | 2,102 | 2,121 |

|

67,409 |

63,072 |

70,098 |

65,524 |

70,188 |

79,414 |

Revenues* | | | | | | |

Dining Room | 421 | 403 | 461 | 461 | 486 | 491 |

Parliamentary Gift Shop | 64 | 87 | 29 | 54 | 69 | 70 |

Constituency Office Allowance Recovery | 737 | 0 | 0 | 0 | 0 | 0 |

Recovery of Prior Year's Expenses | 0 | 23 | 0 | 0 | 0 | 0 |

Lease Revenue | 43 | 42 | 43 | 51 | 68 | 68 |

|

1,265 |

555 |

533 |

566 |

623 |

629 |

Net cost of operations |

66,144 |

62,517 |

69,565 |

64,958 |

69,565 |

78,785 |

*

Classified as internal recoveries in the annual Estimates, but recorded as revenues in the Legislative Assembly’s stand-alone financial statements. |

The Legislative Assembly’s 2015/16 budget of $69.6 million is unchanged from the prior year. Management was able to find efficiencies and savings in several areas of the budget while also matching the one percent raise provided to members of the B.C. Government Employee’s Union. These efficiencies and savings were due in part to the LASPAR review performed in 2015.

One of the primary drivers of the Legislative Assembly’s budget is the number of days the House sits. For each additional day the House sits the Legislative Assembly incurs additional labour and operations costs. By-elections can also result in additional expenses. A modest contingency budget is built into the Legislative Assembly budget to address these factors.

The projected expenses for 2018 are expected to increase by $7.3 million in anticipation of the additional costs required during an election year to transition to a new parliament.

Operating Forecast and Projection Assumptions - Projections include a 1% increase to salaries and benefits per year.

- Forecasted expenses for 2016 are based on branch forecasts at September 30, 2015.

- Projected benefits are estimated using historic trends.

- Non salaries and benefits expenses are expected to remain consistent with the exception of the increases in 2018, which is an election year (as was 2014).

- Sitting days are expected to remain consistent at about 70 days per year.

|

The Legislative Assembly’s 2015/16 budget of $69.6 million is unchanged from the prior year. Management was able to find efficiencies and savings in several areas of the budget while also matching the one percent raise provided to members of the B.C. Government Employee’s Union. These efficiencies and savings were due in part to the LASPAR review performed in 2015.

One of the primary drivers of the Legislative Assembly’s budget is the number of days the House sits. For each additional day the House sits the Legislative Assembly incurs additional labour and operations costs. By-elections can also result in additional expenses. A modest contingency budget is built into the Legislative Assembly budget to address these factors.

The projected expenses for 2018 are expected to increase by $7.3 million in anticipation of the additional costs required during an election year to transition to a new parliament.

Projected Net Cost of Operations

|

Actual |

Budget |

Forecast |

Projected |

(in thousands of dollars) |

2014 |

2015 |

2016 |

2017 |

2018 |

Capital Purchases | | | | | | |

Furniture and Equipment | 242 | 137 | 210 | 188 | 260 | 256 |

Computer Hardware and Software | 735 | 466 | 552 | 614 | 459 | 762 |

Buildings | 64 | 0 | 1,693 | 931 | 990 | 900 |

Vehicles | 34 | 0 | 0 | 0 | 0 | 0 |

Specialized Equipment | 794 | 388 | 375 | 407 | 713 | 686 |

Total Capital Purchases |

1,869 |

990 |

2,830 |

2,140 |

2,422 |

2,604 |

Capital Forecast and Projection Assumptions - Capital expenditures on Buildings is expected to increase in future years.

- Forecasted expenditures for 2016 are based on branch forecasts at September 30, 2015.

- Capital spending is expected to increase in 2018, which is the next election year (as was 2014), when offices will be upgraded and equipment will be refreshed.

|

Risk Management

Like any organization, the Legislative Assembly is subject to various operational, financial, technological, facilities related, and staffing risks. In response, the Legislative Assembly has established internal controls, policies, and processes to assist in mitigating these risks and is actively managing these risks through regular meetings of its Senior Management Team and Audit Working Group. In addition, the Legislative Assembly’s internal audit function conducts operational and control audits and reports regularly to the Finance and Audit Committee (FAC). The FAC also receives regular reports from the Legislative Assembly’s Executive.

| | | |

| |

|

Statement of Management Responsibility

For the year ended March 31, 2015 |

The financial statements and note disclosures of the Legislative Assembly of British Columbia have been prepared by management in accordance with Canadian public sector accounting standards (PSAS). The integrity and objectivity of these statements and disclosures are management’s responsibility. A summary of the significant accounting policies are described in note 2 to the financial statements. Management is also responsible for implementing and maintaining a system of internal controls to provide reasonable assurance that reliable financial information is produced, that assets are safeguarded, that transactions are properly authorized and recorded in compliance with legislative and regulatory requirements, and that reliable financial information is available on a timely basis for preparation of the financial statements. The Legislative Assembly Management Committee (LAMC) is responsible for ensuring that management fulfills its responsibilities for financial reporting and internal control. The Finance and Audit Committee is appointed by LAMC to review the financial statements, the adequacy of internal controls, the audit process, and financial reporting. The Office of the Auditor General of British Columbia has performed an independent audit of the financial statements of the Legislative Assembly of British Columbia. The accompanying Auditor’s Report outlines their responsibilities, the scope of their examination, and their opinion on the financial statements. On behalf of the Legislative Assembly of British Columbia, Original signed by | Original signed by | Craig James | Hilary Woodward, CPA, CA | Clerk of the Legislative Assembly | Executive Financial Officer |

Victoria, British Columbia

On the 23rd day of November 2015 | |

| | | |

| | | |

| | Independent Auditor's Report

To the Members of the Legislative Assembly Management Committee, and

To the Speaker of the Legislative Assembly: We have audited the accompanying financial statements of the Legislative Assembly of British Columbia (“the entity”), which comprise the statement of financial position as at March 31, 2015, and the statement of operations and change in accumulated surplus, statement of change in net debt and cash flows for the year then ended, and a summary of significant accounting policies and other explanatory information.